studbucket

Recycles dryer sheets

We just submitted over $18,000 in payments to pay off our remaining student and auto loan debt, leaving us with only our mortgage as debt. I originally planned to have all this debt paid off by January, but I did better at work than I was planning for ("Don't confuse hope for a plan", right?  ), and we were able to pay everything off easily this month.

), and we were able to pay everything off easily this month.

Given that, it means it's time for us to fully begin investing in our retirement fund. I wanted to lay out our step-by-step plan below and get any feedback you may have for me. Anything you're concerned about or disagree with? Why?

Background Threads

http://www.early-retirement.org/forums/f26/25-married-a-kid-and-optimistic-55271.html

http://www.early-retirement.org/forums/f30/feedback-on-my-allocation-and-direction-55742.html

http://www.early-retirement.org/forums/f30/401k-ira-72t-sepp-vs-roth-ira-55809.html

http://www.early-retirement.org/for...l-assets-for-ultimate-buy-and-hold-56148.html

Our Plan

Given that, it means it's time for us to fully begin investing in our retirement fund. I wanted to lay out our step-by-step plan below and get any feedback you may have for me. Anything you're concerned about or disagree with? Why?

Background Threads

http://www.early-retirement.org/forums/f26/25-married-a-kid-and-optimistic-55271.html

http://www.early-retirement.org/forums/f30/feedback-on-my-allocation-and-direction-55742.html

http://www.early-retirement.org/forums/f30/401k-ira-72t-sepp-vs-roth-ira-55809.html

http://www.early-retirement.org/for...l-assets-for-ultimate-buy-and-hold-56148.html

Our Plan

- I will begin putting the maximum amount of money into the ESPP at work. This should equal to about $1250/month for 3 months, and I will get $225-300 extra when cashing out (after taxes). So, I reduce my cashflow by about $1250/month, but will get it all back plus an extra $75-100/month every 3rd month.

- On average, we will be saving about $2500/month, but because of ESPP, I actually think of it in 3 month chunks. So we'll be saving at least $7500 every 3 months in addition to the ~$700/month that goes into my 401(k).

- Each time that I cash out my ESPP, that means it's investment time. I'm using a modified "Ultimate Buy & Hold" strategy and will currently have an AA of approximately 75/25. My assets and funds will be as follows:

- Short-Term Bonds: VBSSX / VCSH (Inside 401k / Vanguard)

- Intermediate Bonds/Total Bond Market: PTTRX / BND (Inside 401k / Vanguard)

- Total Stock Market: VTI

- International Small/Mid: VSS

- Total International: VXUS

- Small Value: VBR

- My 401k will consist completely of Bonds (VBSSX/PTTRX), and if any additional bonds are needed to hit the 25/75 AA, I will buy those in my Vanguard account (VCSH/BND) during rebalancing time.

- The first $5000 I invest each and every year will go into a Roth IRA. After that it all goes into taxable accounts. (Once my wife gets a job, make that the first $10000)

- Since most of my bonds are part of my 401k, and I'm investing every 3 months, I view myself as being on a 15-month cycle of investing then re-balancing. This is my current schedule for the next year:

- Oct 11: Total Stock Market

- Jan 12: International Small/Mid

- Apr 12: Total International

- July 12: Small Value

- Oct 12: Rebalance

- Jan 13: Start again

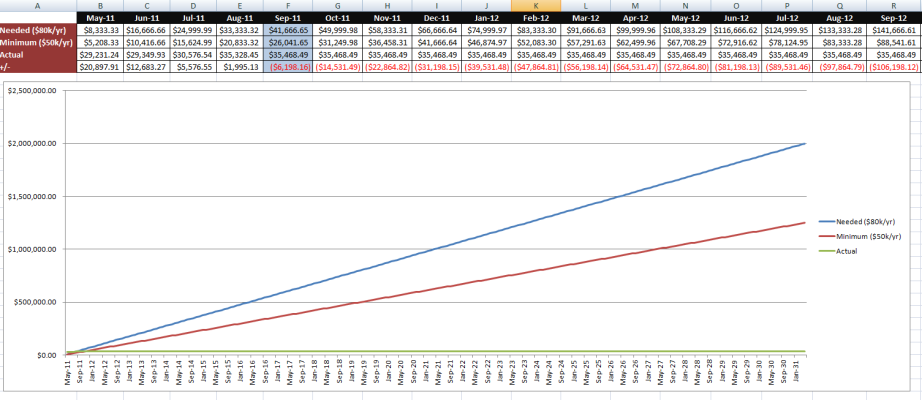

- With a bit of luck (assuming similar historical returns, not getting fired, etc) I should be able to save up $2mm-2.5mm by the time I'm 45. That's ~$65k/year as my starting SWR in 2031.

- None of these savings or calculations include stock awards, bonuses, or my spouse's potential income. Any of those factors will be invested just like all the other cash, but I haven't included it in my retirement calculations.

- I don't know everything, and will obviously have a much better feel for my possible expenses and what my SWR will be closer to retirement, but I'm 20 years away.

- We'll also be putting $325/extra a month on our mortgage. Enough to get it to be paid off approximately 9 years early, and to get our PMI paid off in ~4 years (I know, yuck, I've learned).

- We also have $16k of emergency savings, but would like to increase to $30-35k, and we'll be putting ~$200/month into that, so it will slowly increase.

- I have about $7000 in Sharebuilder/ING accounts in various good or bad stocks that I know nothing about (made 65% in 2 years on WTW and ETH, but have lost on plenty of others). I think I will cash out these stocks when the time seems opportune and play around with dividend growth stocks, see if I can't learn something and make some money that way.

You didn't mention credit card debt, so I am assuming you pay that off each month. If not, then paying off credit cards would be pretty urgent.

You didn't mention credit card debt, so I am assuming you pay that off each month. If not, then paying off credit cards would be pretty urgent.