Sandy & Shirley

Recycles dryer sheets

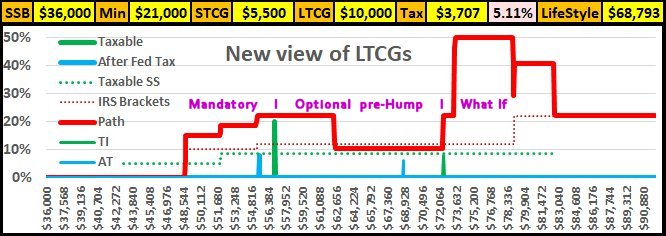

Our mortgage was paid off in 2023. My partner will switch from 70% Survivor benefits to 130% maximum personal benefits in 2026. We are currently 68.8% Roth converted, 52% myself and almost 90% partner.

Plan A is to complete our Roth conversions and to open a pair of standard brokerage account that will eventually be used for LTCG Harvesting.

Looking back about 15 years, I remember a few websites that offered individual stock future recommendations / predictions. They offered short term and long term estimates and listed how many of their analysts agreed and disagreed with each prediction.

We are not looking for stock that will double in value in the next six months. We are more interested in the stock symbols that will probably grow by 8 to 12 percent over the next 12 months and a majority of our analysts agree with that estimate.

Can anyone recommend a few URLs where this type of market analysis is provided?

Plan A is to complete our Roth conversions and to open a pair of standard brokerage account that will eventually be used for LTCG Harvesting.

Looking back about 15 years, I remember a few websites that offered individual stock future recommendations / predictions. They offered short term and long term estimates and listed how many of their analysts agreed and disagreed with each prediction.

We are not looking for stock that will double in value in the next six months. We are more interested in the stock symbols that will probably grow by 8 to 12 percent over the next 12 months and a majority of our analysts agree with that estimate.

Can anyone recommend a few URLs where this type of market analysis is provided?