golftrek

Recycles dryer sheets

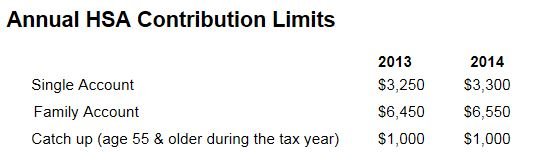

My husband and I (both age 62) have High Deductible HI policies. We established HSAs several years ago. We have funded the HSAs to the max. Last year, using Turbotax, I estimated our Federal and state income tax savings due to the HSAs was around $1,200.

We have just applied for the subsidy on the HealthCare.gov and qualified for subsidies of approx $9,000. The only reason we qualify for the subsidy is that we can deduct our HSA contribution in determining our Modified Adjusted Gross Income.

Between the income tax deduction and the subsidy we figure our HSAs will save us around $10,200 next year. And in addition we have over $50,000 (invested in Vanguard mutual funds) in our HSAs growing tax free that we can draw on if we need it.

I highly recommend you look into an HSA if you are under 65.

Jo Ann

We have just applied for the subsidy on the HealthCare.gov and qualified for subsidies of approx $9,000. The only reason we qualify for the subsidy is that we can deduct our HSA contribution in determining our Modified Adjusted Gross Income.

Between the income tax deduction and the subsidy we figure our HSAs will save us around $10,200 next year. And in addition we have over $50,000 (invested in Vanguard mutual funds) in our HSAs growing tax free that we can draw on if we need it.

I highly recommend you look into an HSA if you are under 65.

Jo Ann

I shouldn't be posting on these ACA sites, as it doesn't affect us. NOMB.

I shouldn't be posting on these ACA sites, as it doesn't affect us. NOMB.