pixelville

Recycles dryer sheets

- Joined

- Jan 3, 2010

- Messages

- 183

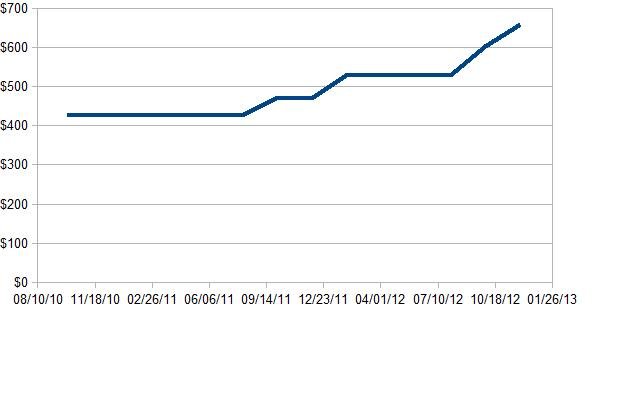

Got my latest health insurance premium increase. The plot shows how my premiums have increased in the 2 years that I have had HDHP policy with BCBS. No claims.

25% per year. 4 increases in 2 years.

Just wanted to share in case it helps someone plan their budget.

Feel free to share your trend lines.

25% per year. 4 increases in 2 years.

Just wanted to share in case it helps someone plan their budget.

Feel free to share your trend lines.