You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Social Security/Medicare rip off

- Thread starter l2ridehd

- Start date

Blame your parents.I am in the process of applying for SS and Medicare. Just got off the phone with them after completing the online application. The issue: SS checks are with held one month so you are delayed getting the check. However Medicare has to be paid one month in advance. So the first check you receive which is delayed one month after the SS start date will have two months of Medicare payments removed. So what you get is delayed a month, what you have to pay has to be paid a month in advance.

My congressman is getting a letter, what a rip off.

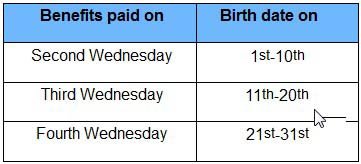

Social Security disability, survivor, and retirement benefits are paid in the month after they are due. The benefit payment day is determined by the beneficiaries' birth date.

Benefit payment dates for Social Security

Attachments

OK, I understand, no sympathy here. Guess I will just grin and accept it. Be a lemming and follow the crowd. Probably should worry more about getting paid at all then when I get paid. Better to get something from them then nothing.

Better yet, next time try to be born in the first 10 days of the month.OK, I understand, no sympathy here. Guess I will just grin and accept it. Be a lemming and follow the crowd. Probably should worry more about getting paid at all then when I get paid. Better to get something from them then nothing.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

I discovered this "next month is not really next month until another month has passed" game when I signed up for SS benefits in 2008. I did some calculations at the time and determined the genius who came up with the idea for the one month delayed start was saving SS a little more than $2B per year.

Rustward

Thinks s/he gets paid by the post

- Joined

- Apr 19, 2006

- Messages

- 1,684

Just tell them it sucks and you don't need no stinkin' money!

GregLee

Thinks s/he gets paid by the post

I was! And tomorrow is the second Wednesday!Better yet, next time try to be born in the first 10 days of the month.

justplainbll

Recycles dryer sheets

What's good for the goose should be good for the gander. SS, Medicare and the IRS are all part of the same beast. The IRS performs some collection services for SS. Timeliness seems to be a one way street.What does this have to do with SS and Medicare?

I think you are assessed a penalty for not paying sufficient estimated tax and charged interest for not being timely.

Telly

Thinks s/he gets paid by the post

- Joined

- Feb 22, 2003

- Messages

- 2,395

Not only do you get paid for each month in the following month but the payment received in the month of your death (for the month you were alive) goes back to the SS admin.QUOTE]

Beat SS at their own game. Don't die.

Now THAT is dastardly! Then SS really will crash. And I predict that Doctors will cease taking ALL Medicare patients...

Doctor to office staff: No Medicare patients! None! Don't even let them into the waiting room! They'll be dropping body parts and worn-out fluids all over our furniture and magazines!!!

Bikerdude

Thinks s/he gets paid by the post

- Joined

- Jul 4, 2006

- Messages

- 1,901

+1Make a protest sign. Whine. Get emotional in front of a reporter. It's somewhat popular these days.

-ERD50

Waaa, Waaa!

justplainbll

Recycles dryer sheets

Most doctors accept patients by appointment. They act like they're doing you a favor to fit you into their busy schedules and for medicare patients, if they have not opted out, usually limit their time spent per patient to around 5 minutes.Now THAT is dastardly! Then SS really will crash. And I predict that Doctors will cease taking ALL Medicare patients...

Doctor to office staff: No Medicare patients! None! Don't even let them into the waiting room! They'll be dropping body parts and worn-out fluids all over our furniture and magazines!!!

Perhaps you would not have such a cavalier attitude if

-you paid the medicare tax since its inception

-made FICA contributions for some 40 years

-deferred collection of SS retirement benefits until 53 years after first year of contribution.

-had to pay income tax on SS retirement benefits

-had to pay income based surcharges on medicare part B

-had to pay medicare part D surcharges even though you have an employer sponsored drug plan

-had to pay hefty income taxes while others get tax 'refunds' in excess of any income taxes they have paid.

Things change and not necessarily for the better for those who started out following the rules. Some call that progress.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Bll, you are a real ray of sunshine...

justplainbll

Recycles dryer sheets

Perhaps because my deceased DDS buddy's nickname was sunshine.Bll, you are a real ray of sunshine...

He was one of those people who got an annual flu shot because it was 'free'.

Telling it like I've seen it is. My dad went to his MD regularly every 3 months. He had many of the symptoms of non-hodgkins lymphoma but was not diagnosed until he was stage 3. My mother died from a pulmonary embolism 3 days after an alpha-hotel radically increased her dosage of procrit (the tamoxifen didn't help either).

The longevity of my parents fell quite short of my grandparents despite the fact that my grandparents lived the bulk of their lives without most of the 'benefits' of our nanny government and my parents' lifestyle was similar to that of their parents.

Last edited:

teejayevans

Thinks s/he gets paid by the post

- Joined

- Sep 7, 2006

- Messages

- 1,691

So I was born at the end of the month, its like getting free health care for a month...I love this system!!Medicare starts the first of the month that you turn 65, regardless of the date of the month.

TJ

justplainbll

Recycles dryer sheets

In my area, an alarming number of DOs and MDs are giving up their private practices and migrating to salaried positions.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Most doctors accept patients by appointment. They act like they're doing you a favor to fit you into their busy schedules and for medicare patients, if they have not opted out, usually limit their time spent per patient to around 5 minutes.

I won't notice any difference then when I become a medicare patient, that's all I have ever got with my primary doc.

justplainbll

Recycles dryer sheets

There has been no COLA for the past two years.That's when the annual SS benefit statement is sent out, along with any increases due to COLA adjustments.

Often this information is not available till late in the year, and the proper program changes are made.

Until you receive this statement of benefits, any "guesstimate" is just that.

Yes, been there - done that.

rescueme

Thinks s/he gets paid by the post

The only folks receiving the annual statement of benefits are those that claimed SS in the last two years.There has been no COLA for the past two years.

Those that were already on SS did not receive a statement, since the SS benefit amout remained the same, including the Part B Medicare charge.

With the expected COLA increase (regardless of what it is), everybody on SS will receive a statement of notification of benefits (along with the increase of Medicare) just prior to January 1, since the first new/adjusted payment will be on January 11th.

Don't confuse this form with your annual SS statement (which is no longer sent, anyway). It has a diffferent use.

JOHN CARRIGAN

Dryer sheet wannabe

You may not be so pleased if you find out that some of your doctors will not accept medicare patients.

Now that's a fact

JOHN CARRIGAN

Dryer sheet wannabe

That's when the annual SS benefit statement is sent out, along with any increases due to COLA adjustments.

Often this information is not available till late in the year, and the proper program changes are made.

Until you receive this statement of benefits, any "guesstimate" is just that.

Yes, been there - done that.

What COLA adjustments? I've not seen one in several years!

rescueme

Thinks s/he gets paid by the post

The last two (not several).What COLA adjustments? I've not seen one in several years!

There will be one effective Jan 1, 2012 (this has been under discussion on this board, with a guesstimate of around +3.5%).

However, if you have being paying for Medicare Part B over the last two years (without the COLA), be prepared to have an increase in that deduction from your SS.

Last edited:

JOHN CARRIGAN

Dryer sheet wannabe

Thanks for the update. Great to hear some good news from social security.

GregLee

Thinks s/he gets paid by the post

A substantial rise in Medicare Part B premiums will affect Hawaii state finances, because it pays those premiums for its approximately 37,000 retirees. The fund to cover health insurance for state employees and retirees is already $14 billion in the hole (Honolulu Civil Beat - Hawaii Budget Chief: Tax Hikes Likely to Cover Cost of Retirees' Health Care - Article).However, if you have being paying for Medicare Part B over the last two years (without the COLA), be prepared to have an increase in that deduction from your SS.

mickeyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My congressman is getting a letter, what a rip off.

Aww don't waste your time. SS and Medicare will be bankrupt before you know it and you will not have to make any more payments to MC.

Similar threads

- Replies

- 4

- Views

- 301

- Replies

- 28

- Views

- 1K