Htown Harry

Thinks s/he gets paid by the post

- Joined

- May 13, 2007

- Messages

- 1,525

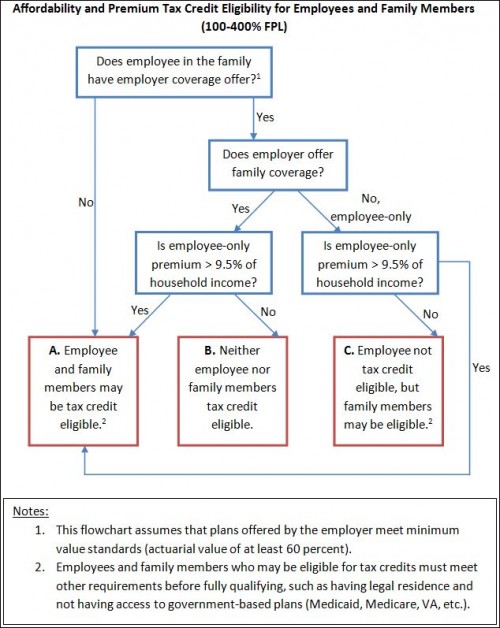

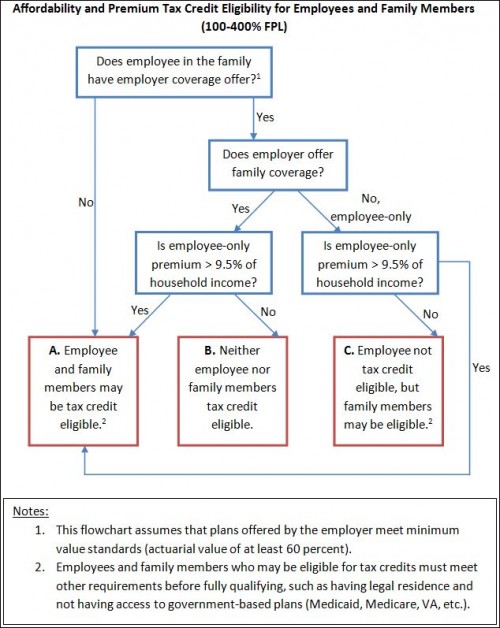

The most confusing source of premium tax credit eligibility made simple, in one chart | The Incidental Economist

This chart may be helpful for those of us thinking about semi-ER scenarios where one of the spouses has a low salary but has HI coverage through work.

This chart may be helpful for those of us thinking about semi-ER scenarios where one of the spouses has a low salary but has HI coverage through work.

Many people want to know if they are eligible for premium tax credits for marketplace (exchange) plans. I’ve been asked this question numerous times and seen and heard it asked of others. The typical answer is that if you have coverage from an employer or public program, you are not eligible for tax credits. That typical answer leaves one big thing out. Some people with employer-based coverage are eligible for tax credits. If that coverage is deemed unaffordable, tax credit eligibility is conferred.