Looking4Ward

Full time employment: Posting here.

I sure hope he's right.

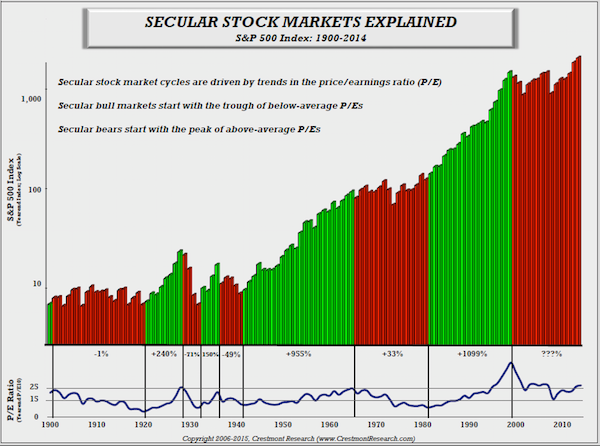

"The first week of 2016 started with a big move down in equity prices as a result of geopolitical events in emerging markets and fears of slowing economies worldwide. However, these and other reasons ignore the larger trends influencing markets today.........We believe the market has begun the next secular bull market that will last another 15 to 20 years."

A Bear Market For The Next 15-20 Years?

"The first week of 2016 started with a big move down in equity prices as a result of geopolitical events in emerging markets and fears of slowing economies worldwide. However, these and other reasons ignore the larger trends influencing markets today.........We believe the market has begun the next secular bull market that will last another 15 to 20 years."

A Bear Market For The Next 15-20 Years?