Senator

Thinks s/he gets paid by the post

The Bank of Japan surprised markets on Friday by pushing interest rates into negative territory for the first time ever. By doing so, the BOJ is essentially charging banks for parking excess funds.

Bank of Japan's negative rates are 'economic kamikaze': Boockvar

Another reason for the Fed to raise rates.

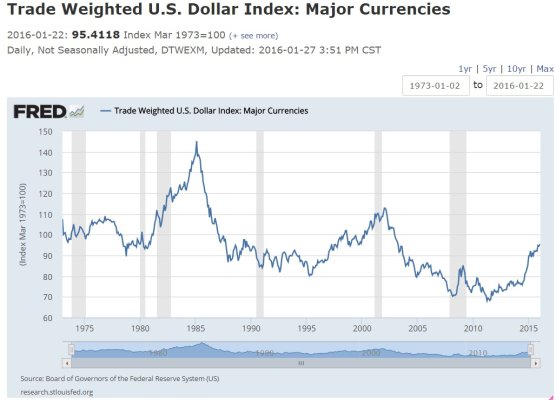

If we raise rates a few more times, maybe we can have the strongest currency the world has ever seen, and the most expensive exports the world has ever produced. Perhaps companies can ship jobs overseas ever faster to generate more profits. [/sarc]

If we raise rates a few more times, maybe we can have the strongest currency the world has ever seen, and the most expensive exports the world has ever produced. Perhaps companies can ship jobs overseas ever faster to generate more profits. [/sarc]It's amazing how the Fed thinks the USA is in a vacuum... Plan on a low return environment for years to come unless we can get out of this deflation funk.