yakers

Thinks s/he gets paid by the post

I am thinking about holding a small amount of my portfolio in 'hard' gold. So I am interested in whether to hold coins or bullion and legitamite sources.(APMEX?) How to minimize handling costs?

In a true SHTF scenario, it will be months before a stable trading system is in place, due to all of those who buy dinner on the way home from the office every night. They will be the ones, who will do ANYTHING to get what they want, and feed their families, causing chaos everywhere, and making it dangerous to venture out.

Back in 2015, he had to sell three graduation rings — one was his wife’s, one was their daughter’s and one was his — to afford plane tickets for their two daughters to move to United States, away from the Venezuelan economic and political crisis. “It’s harsh. I don’t regret it, but I feel sadness of having the necessity to sell them,” he said.

What about the GLD etf?

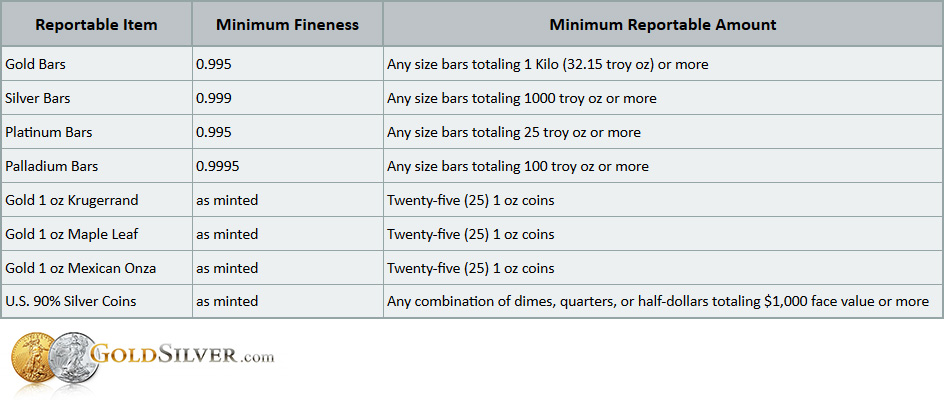

Gold coins with fractional denominations; Gold and Silver American Eagle Coins; any pieces of foreign currency that were not mentioned in the IRS’s Reportable Items List; and any pieces of US currency that were created subsequent to the list’s creation are all exempt from reporting through a 1099-B form. However, any of the coins or bullion pieces that are mentioned on the IRS’s Reportable Items List are subject to reporting, provided they meet the prescribed quantities. These include 1 oz Gold Maple Leaf Coins; 1 oz Gold Krugerrand Coins; the 1 oz Gold Mexican Onza Coins and any US coin composed of 90% silver, as well as all precious metal bars and rounds.

If going into Gold for SHTF scenarios mind as well stock up on water purification, and food as well.

Ammo, antibiotics, medical supplies, toilet paper...

And small bottles of alcohol

You should be able to get a roll of 20 for under 26k at today's price.... Good news is, it won't take up much room in your safe.Yeah me thinks I'll get one of those 20 piece 1 oz gold eagle mint packs and toss it in the safe.

Small? C'mon, you can clean wounds with it, light fires, drink it, etc. I was thinking more like a barrel.

I was thinking small amounts for ease of commerce.

Eh, put your head under the tap and I will dispense the agreed amount.