I heard INTEL is a screaming buy.............

But now that you mention it, I did recommend INTC a little while back and I think a bunch of people around here have made a good chunk of change off of that recommendation...

For a guy who posts as "FinanceDude", the level of detail to your analysis (let alone its quality) leaves a little to be desired.

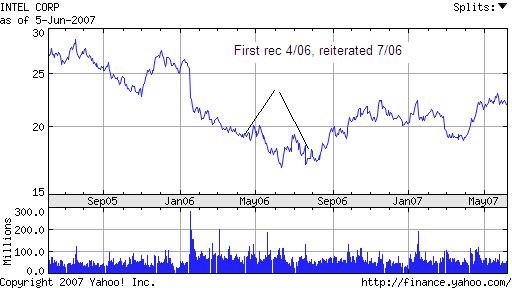

But, yes, I was buying last July/Aug at $17.43 & $17.79/share. With reinvested dividends I'm up 24% at yesterday's close.

I bought because Otellini seemed to be leading his way out of a wet paper bag with rising margins & cash flow due to cuts, because the trading volume seemed to have shaken out, and because certain former Intel employees speculated that Intel would sucker AMD into huge capital expenditures that would nail AMD's profits when Intel dropped chip prices.

I do find it interesting that you keep referring to 10-15 year periods in comparing index funds to indivdual stocks. Those of us who manage stock portfolios do rebalancing in the portfolios on an ongoing basis. I tend towards buy and hold but have up to 50% turnover in my most aggressive portfolios.

I can see the connection between index funds and managed funds, as far as apples to apples. However, I am NOT a fund manager, I have a LOT more flexibility in what I do...........

Hey, indexes rebalance too. Witness what happened to the S&P500 during the 1990s. I don't know index turnover ratios but I suspect they're lower than 10%.

The reason for the long-term comparison to an index is that it's difficult to distinguish luck & the market's rising tide from a manager's actual skill. I'd go for 20 years, personally, and that drops out even Bill Miller. About the only people left are guys like Fisher, Ruane, Schloss, Buffett, and Simpson. Hmmm, I'm noticing personality & lifestyle traits among those guys that I don't believe I possess.

So yes, stock-pickers can beat the market. It probably takes a certain amount of hard-wiring and even so a lot of man-hours. But if a stock-picker isn't comparing their after-tax performance to an appropriate index then they're just deluding themselves with feel-good poor-quality analysis. And even if they're beating the index despite higher turnover costs, one would want to take risk (volatility) into account.

In my case I decided that, although my learning curve is finally paying off, there are better things to do with my time. When I was working I definitely wouldn't have had the time to do this properly, and I'm not sure that I would've had the intestinal fortitude to put the ER portfolio into it either. Now that I'm lazy and lack a profit motive I think I'm heading for a brick wall.

So I'm looking for the exit points with Intel, Diana Shipping, Eagle Shipping, Tate & Lyle, & Superior. I think my shorts on Abercrombie & Fitch and First Fed have room to run for a while...