How does this lead to the conclusion that 2016 is like the 1930's?Jokes aside. The counterparty risk is less transparent today with global connectedness. Much more risk of contagion today than during the GD.

Fascinating - sitting where we are today ... In 2016 And sitting at 1932 as a comparison...no one then knew there would be another world war and that is what it would take to lift us from the depression. Hindsight is 20-20.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is this market like 1932 ?

- Thread starter papadad111

- Start date

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

I'm not sure it leads to any conclusion.

The original question which I posed, was whether or not that is the case.

It's open for discussion and debate by the forum.

The original question which I posed, was whether or not that is the case.

It's open for discussion and debate by the forum.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

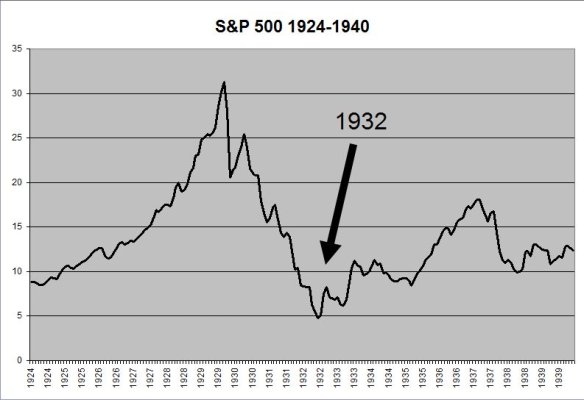

Well. I did mean 1932..... In that There was a pronounced market crash. 1929. A recovery, 1930-1931 and then another crash. 1932.

Um, OK, if you say so. But just so we're on the same page, this is what the market did from 1924-1940 according to data published by Robert Shiller. I'm not sure where you got that paragraph about a big recovery and then a crash in 1932, but I'm not seeing it. (his data is here . . . http://www.econ.yale.edu/~shiller/data.htm )

When drawing parallels between now and the 30's most economists I've read site the premature tightening of the Fed around 1937 that knee-capped the recovery. You can see the S&P 500 sell off at that time. 1932 meanwhile was the ultimate bottom of the market.

Attachments

Last edited:

My misunderstanding. I though you were suggesting that the current situation was leading to a 1930's type outcome. By the responses so far, it seems no one, including you, thinks that is happening. Good thing, eh?I'm not sure it leads to any conclusion.

The original question which I posed, was whether or not that is the case.

It's open for discussion and debate by the forum.

Senator has raised some important issues about deflation and slower growth. A different scenario and outcome, though.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The fed did not exist until 1932 and was incompetent then to fix the economy too.

No soup for you!

Federal Reserve founded 12/23/1913

https://www.google.com/?gws_rd=ssl#q=when+was+the+federal+reserve+founded

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

For the doom and gloomers, here's former Treasury Secretary Larry Summer's downside economic scenario. This comes from a Council of Foreign Relations round-table held the other day on Economic & Political Risks in 2016.

Enjoy

Enjoy

HAASS: When you say serious economic downturn, what is it—what would that look like?

SUMMERS: So I’m going to answer the question, but I don’t want anybody to confuse my answering the question what would serious economic downturn look like with my predicting that there will be such a serious economic downturn. I said one in three of a recession. By the way, if the Fed actually carries through with four increases this year, then I think it’s probably closer to one in two of a recession. But I don’t think they—but I don’t think they will, which is why I’m predicting one in three.

But what does it—what does it look like? The confidence in China starts to deteriorate. As in some—as in February, they have to spend $250 billion holding the currency, and people calculate that at that rate the reserves will all be gone in a year, so they can’t do it. And then they have to spend $350 billion in March or they can’t do it, so at some point they give—at some point they give up. The currency falls 15 percent, 20 percent, exporting huge pressure—deflationary pressure to the rest of the world and leading to a major switch in demand towards China. In that process, the price of oil falls to a point where the world is glutted with it and it has to be stored on tankers, which is enormously expensive, and so the price falls below $20. There’s a revision in sentiment about the global economy in the United States, and so stock market investors decide that the price-earnings ratio on the U.S. market, instead of being at the 85th percentile of history, should be at the 25th percentile of history, and at the same time corporate profits fall by 20 percent. And those two things are sufficient to take the Dow to 8,500. The—

HAASS: Can I withdraw the question now? (Laughter.)

SUMMERS: But I’m saying, I don’t expect any—I don’t expect any of that. But just think about the last—think about the last thing I said. Is it—it’s not—it’s not at all what I would predict, but it is not beyond the realm of possibility that multiples in U.S. markets would start to look like a significantly below-average level rather than a significantly above-average level. And it’s not beyond the realm of possibility that, in a troubled global economy, profits would fall 15 or 20 percent. And then the rest of it is arithmetic. And, you know, by the way, I think we’ve done a great deal to make financial institutions more robust, but if you take a scenario of the kind that I just described, there would at least be some questions about some major global financial institutions.

Again, that’s not my prediction, but it is why I think those who are worried about overheating the economy and generating inflation, rather than being worried about slowdown, low-flation, and difficulty of response, are sort of entirely missing the central issue of our time, from an economic point of view.

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

No soup for you!

Federal Reserve founded 12/23/1913

https://www.google.com/?gws_rd=ssl#q=when+was+the+federal+reserve+founded

My error. SEC was founded in '32

It was Glass-Steagal in '33 and the banking act of 1935 that changed the structure of the fed significantly that I was thinking about : http://www.federalreservehistory.org/Events/DetailView/26

The issue that inspired the broadest debate was the structure, powers, and functions of the Federal Reserve System. This issue was the focus of the portion of the act known as Title II, Amendments to the Federal Reserve Act. This portion expanded the powers of the Federal Reserve; shifted power from the regional reserve banks to the Board based in Washington, DC; clarified and codified the relationship between the Federal Reserve and the executive and legislative branches of the federal government; and reorganized the Federal Reserve’s leadership structure.

Last edited:

Redbugdave

Thinks s/he gets paid by the post

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

OTOH, in 1932 my grandfather was able to buy a foreclosed 6 bedroom oceanfront home for $12,000.

. . . but only earned about $1,000 per year.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,428

. . . but only earned about $1,000 per year.

But the house was appraised at more than twice the $12K at the time. He essentially picked up the outstanding mortgage; much to the bank's pleasure.

Been thinking about the market and what's been transpiring. I'm not a market historian but it feels like we can draw some parallels to 1932 and we all know that was a dead market for the next 15 years, til the end of WW2. Fed raised too quickly after the big crash... sent the economy into a stagnant state til the end of the war. War didnt help, of course, but could we be on the verge (as Bogle suggests) of very anemic (or even negative REAL) returns for the next decade?

Ben B was at least well schooled and studied this time period. Janet less so....

Thinking of sequence of returns risks... Anyway, just wonder if we have any economists or historians (or those who might have lived through it...ya never know) who studied that period of time indepth that can share parallels and/or perpendiculars...

I don't believe the depression era leaders had any macroeconomic tools or even solid theory to work from, the way we do today. Gold standard severely severely severely limited what could be done on the supply side.

Sent from my iPhone using Early Retirement Forum

After looking at that chart...The dog and I buried all our investments in the back yard. Is it time to dig it up, now?

I just thought I would revive this thread with a little sarcasm. The sky is falling sells magazines.

Whew! I was worried until I noticed this was a graph of the DJIA.

No worries. I don't invest in the Dow /sarcasm

CaliforniaMan

Full time employment: Posting here.

Perhaps part of the confusion is that the title of your post should have been "Is this Market Like 1937." That makes more sense to me, keeping in mind that the aftermath of 2008/2009 was nothing like that of 1928/29 because the response by government's world wide was much, much better.

We do, surprisingly enough, learn from history (well, at least institutions like the Fed do.)

Which also leads us to the reasonable possibility that the Fed will not blindly keep tightening monetary policy in the face of all evidence in 2016 and beyond. Thus far they've raised rates by 0.0025 and are not honor bound to raise any more. Futures markets have dramatically cut the odds of another Fed increase.

If inflation continues to be a no-show and the labor market softens, I'd say the Fed tightening will be "one and done."

Well, we haven't enacted any crippling tariffs or any started trade wars like they did in 1930 -- yet.

Markola

Thinks s/he gets paid by the post

OTOH, in 1932 my grandfather was able to buy a foreclosed 6 bedroom oceanfront home for $12,000.

Problem/Opportunity

+1. My dear great grandfather (DGGF?) was born on a farm but later had a pharmacy in rural GA and used the profits to come out of the Depression with 6,000 acres of timberland. The rest of the story is that he turned down an opportunity to buy Coca Cola stock from a salesman from Atlanta because land was more useful than some flavored carbonated water drink company, and what fool would waste good money on that?

To be fair turning down a slick (traveling?) salesman from the big city peddling stock is a very good decision rule to live by

And farmland returns aren't too shabby it seems (random google):

https://www.extension.iastate.edu/agdm/articles/edwards/EdwMay10.html

And farmland returns aren't too shabby it seems (random google):

https://www.extension.iastate.edu/agdm/articles/edwards/EdwMay10.html

Markola

Thinks s/he gets paid by the post

To be fair turning down a slick (traveling?) salesman from the big city peddling stock is a very good decision rule to live by

And farmland returns aren't too shabby it seems (random google):

https://www.extension.iastate.edu/agdm/articles/edwards/EdwMay10.html

Interesting article. Not to get us even further off-topic but, interestingly, professional pine forest managers on the SE coastal plain often aim for about a 4% sustainable annual return to landowners, i.e. just like farming stock/bond portfolios for a SWR!

Last edited:

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

The attached article is rather interesting and gets us back on topic:

Stocks are catching spring fever. The Dow Jones industrial average and S&P 500 officially wiped out their year-to-date losses this week, as the weight of the Fed was lifted from investors' shoulders. If the Dow can hold its gains through the end of the month, it would mark the biggest quarterly comeback since 1933.

Of course...we all know what happened next ...

The Dow is doing something it hasn't done since 1933

Stocks are catching spring fever. The Dow Jones industrial average and S&P 500 officially wiped out their year-to-date losses this week, as the weight of the Fed was lifted from investors' shoulders. If the Dow can hold its gains through the end of the month, it would mark the biggest quarterly comeback since 1933.

Of course...we all know what happened next ...

The Dow is doing something it hasn't done since 1933

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

One more as we close out Q1 today.

The Dow is poised to close out the first three months of the year in the green, after the worst start ever to a year. The Dow's quarterly comeback was its biggest reversal since 1933. (CNBC)

Pretty fascinating. I'm no macro economist but I wonder what other parallels we will see going forward.

The market reversal and similarities to 1932 (ok 1933) certainly lend some pause for thought

The Dow is poised to close out the first three months of the year in the green, after the worst start ever to a year. The Dow's quarterly comeback was its biggest reversal since 1933. (CNBC)

Pretty fascinating. I'm no macro economist but I wonder what other parallels we will see going forward.

The market reversal and similarities to 1932 (ok 1933) certainly lend some pause for thought

dixonge

Thinks s/he gets paid by the post

The market reversal and similarities to 1932 (ok 1933) certainly lend some pause for thought

Why? Why would today's huge, complicated, insanely fast market have any relation whatsoever to the 1930's market?

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

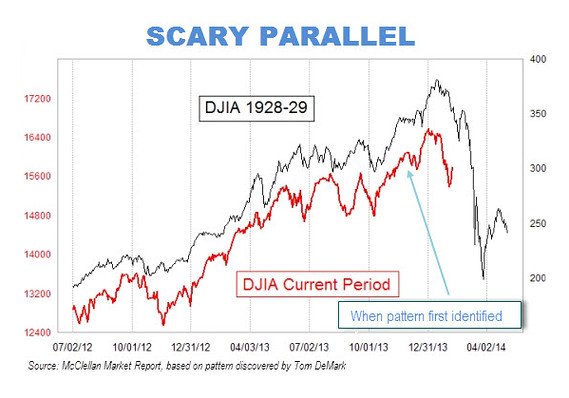

The market reversal and similarities to 1932 (ok 1933) certainly lend some pause for thought

So what exactly do you see between these two markets that looks similar to you?

Attachments

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

For me, given that markets contain a human element and humans tend to repeat their behaviors, I suppose it's the behavioral finance aspect of market crashes and market rallies that are interesting to me.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The lines seem to go from Left to Right?So what exactly do you see between these two markets that looks similar to you?

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

The lines seem to go from Left to Right?

Markets go up, markets go down and sometimes crashes happen?

DrRoy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why would today's huge, complicated, insanely fast market have any relation whatsoever to the 1930's market?

It wouldn't. Human brains have a tendency to look for patterns in data. This was apparently good for our ancestors toward finding food, but gets us in a lot of trouble with our investments now. I recommend Your Money and Your Brain by Jason Zweig.

Similar threads

- Replies

- 12

- Views

- 2K

- Replies

- 39

- Views

- 3K

- Replies

- 21

- Views

- 3K