Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

But not the only reason. If your product doesn't have additional demand, it just may not make sense to invest capital to make more of those widgets.

I think we're mixing a lot of different things together.

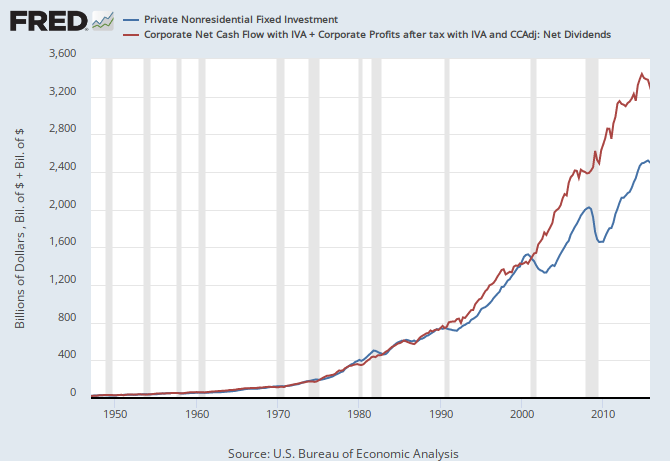

The original comment by MB was that we had low capacity utilization, and that explained why we didn't have more CAPEX. That's a fair point.

But we don't just have low utilization. We have low utilization and high margins. So why not run existing plant more? It's not necessarily a matter of investing new capital, it's a matter of working existing capital harder to reap more of those high margins.

Now with that as a table setting, your point about possible lack of demand is also a fair point.

But that leaves us with a situation where people are willing to pay high prices on existing sales but there is no additional demand for more units even at lower prices. That's hard for me to conceptualize across an entire economy.

And even if we can come up with a theory for why that last paragraph is true, we'd also need a theory of why new competitors haven't driven margins down by trying to take market share from incumbents.