Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hi guys, a little update.

(I forgot my password for Fermion and lost access to the email account so created a new user name)

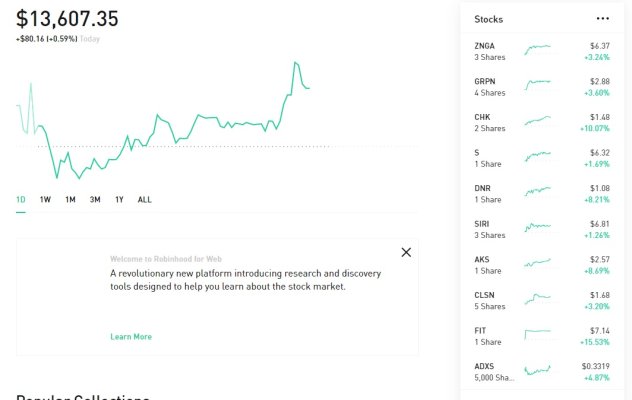

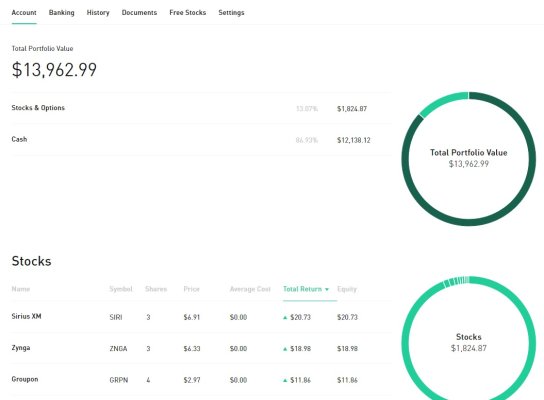

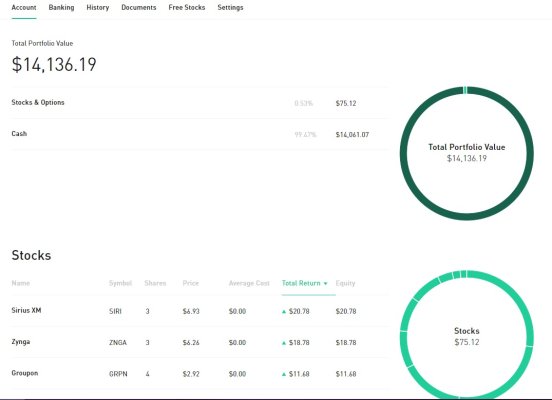

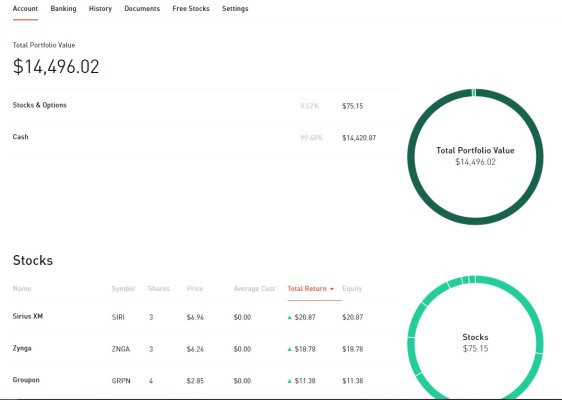

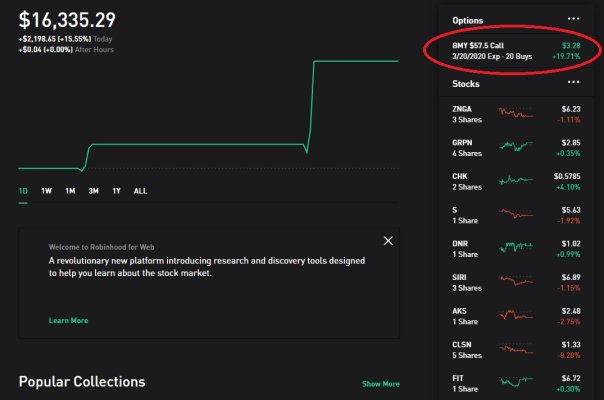

I am still trading in RobinHood and still working on the personal contest to massage $2500 into $250,000 in ten years.

Currently I am sitting at $11,750 and change, mostly cash except for 10 Gilead $65 call contracts expiring Jan 2020 that are down about $1200. My past trades in Merck have more than made up that little mishap of Gilead but I still hold out hope that $62 a share is just a little low value...we shall see. Every time some news comes out about biotech destruction because of price controls is when I have been buying and I sell a few days later when it recovers. It has been working fairly well. I should have held on to a little more Merck as it recovered more than others but oh well.

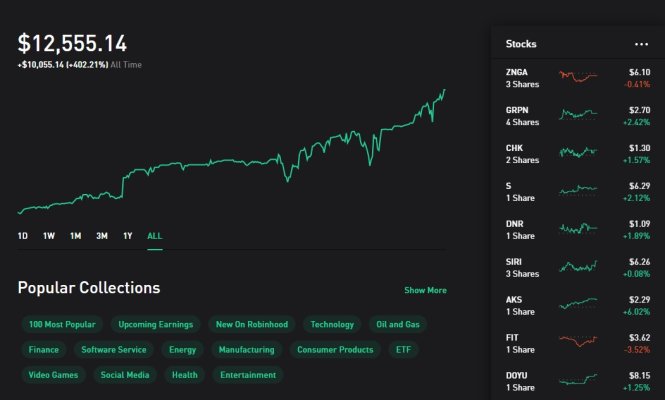

Currently up some 370% since a little over a year ago when we started this adventure.

(I forgot my password for Fermion and lost access to the email account so created a new user name)

I am still trading in RobinHood and still working on the personal contest to massage $2500 into $250,000 in ten years.

Currently I am sitting at $11,750 and change, mostly cash except for 10 Gilead $65 call contracts expiring Jan 2020 that are down about $1200. My past trades in Merck have more than made up that little mishap of Gilead but I still hold out hope that $62 a share is just a little low value...we shall see. Every time some news comes out about biotech destruction because of price controls is when I have been buying and I sell a few days later when it recovers. It has been working fairly well. I should have held on to a little more Merck as it recovered more than others but oh well.

Currently up some 370% since a little over a year ago when we started this adventure.