I am going to post the end of year results for this RobinHood contest (with 1 player) since I am all cash and plan to be all cash until Jan 1 for tax/ACA reasons.

Yes, the tax man is wagging the dog, something I did not expect so soon when I started this account with a piddly $2,500. As it grows and gets into bigger money, like $50,000+, I guess taxes will have much more of an effect on how I trade. Shame, but RH doesn't do IRAs so I really had little choice when I started if I wanted totally free commissions.

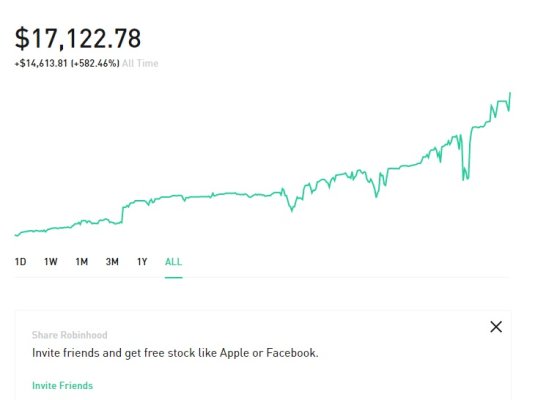

So we end the year at $17,420, an all time gain over 590%.

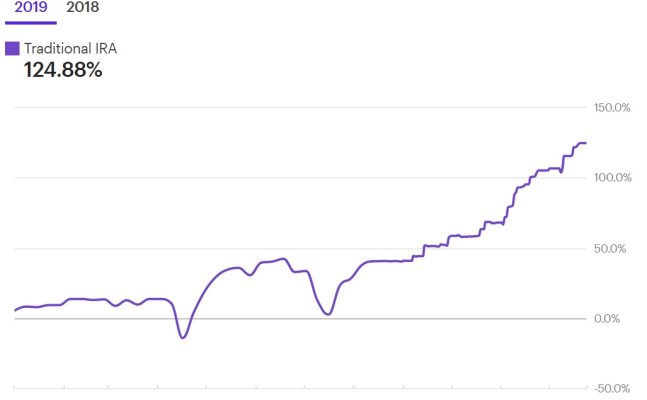

As far as other interesting things, in my IRAs I have purchased 700 shares of Bluebird and 2000 shares of Nektar in hopes of either or both of them generating some good returns in 2020. I may copy these trades in this account if they pull back significantly on "not so bad" news. It sure would be nice to see Nektar bought out in 2020 though. That IRA would double.