nash031

Thinks s/he gets paid by the post

Thinking about this reading through doom and gloom posts based on historical similarities, etc.

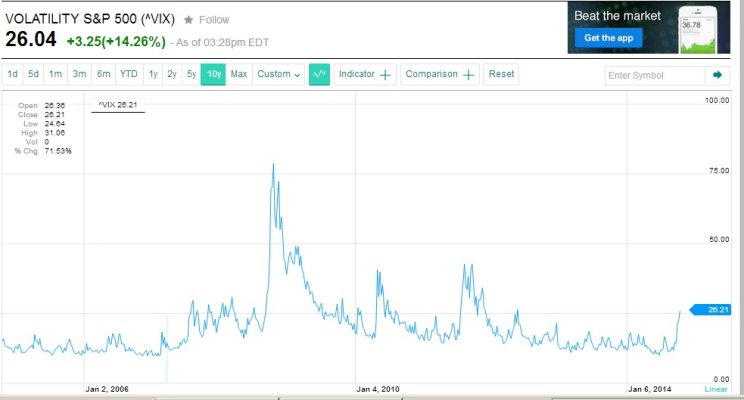

It struck me that the sheer glut of information available today regarding markets and economics impacts volatility greatly. The economic indicators from 1966 or 2008 may be similar, but society as a whole has changed how we live even since 2008 (and certainly since 1966, 1982, 2000, etc.) with the spread of smartphones allowing folks access to financials in the palm of their hand, 24/7.

As in most cases, I hesitate to use historical anecdotes to impact my investment strategy because rarely is "this time" just like "last time this happened."

It struck me that the sheer glut of information available today regarding markets and economics impacts volatility greatly. The economic indicators from 1966 or 2008 may be similar, but society as a whole has changed how we live even since 2008 (and certainly since 1966, 1982, 2000, etc.) with the spread of smartphones allowing folks access to financials in the palm of their hand, 24/7.

As in most cases, I hesitate to use historical anecdotes to impact my investment strategy because rarely is "this time" just like "last time this happened."