Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

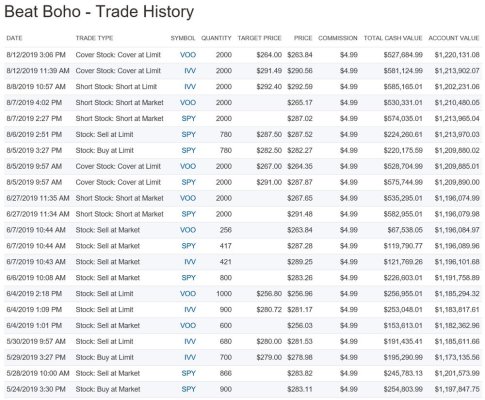

Looks like Boho might have been partially "exited"? Awfully close, maybe the SPY order was not filled, and so far VOO has come close to his Buy-To-Cover, but no cigar?

SPY day range so far: 290.90 - 294.12

VOO day range so far: 267.16 - 270.06

-ERD50

I checked a couple of times today. Close but my trades didn't execute yet.