COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Let me be perfectly clear here. The market WILL go up and the market WILL go down. And I will be right...always.

as a matter of fact most individuals that invest in passive markets believe that markets are entirely predictable and expect prices to go ever higher, any low will be soon reversed and a new high achieved

Over the past 60 years or so, the S&P 500’s composition has changed dramatically. In 2007, the index’s 50th anniversary, S&P published a list of the 86 companies that remained from the original lineup. That number has steadily declined, and today, only about 60 original members remain.

As original members have dwindled, so has the average tenure of companies in the index. In 1964, the average index tenure of an S&P 500 company was 33 years. As of 2016, tenure shrank to 24 years, according to Innosight, a consulting firm. By 2027, Innosight expects S&P 500 tenure to shrink to 12 years.

“Record private equity activity, a robust M&A market, and the growth of startups with billion-dollar valuations are leading indicators of future turbulence,” Innosight explained in a report (pdf). “At the current churn rate, about half of S&P 500 companies will be replaced over the next ten years.”

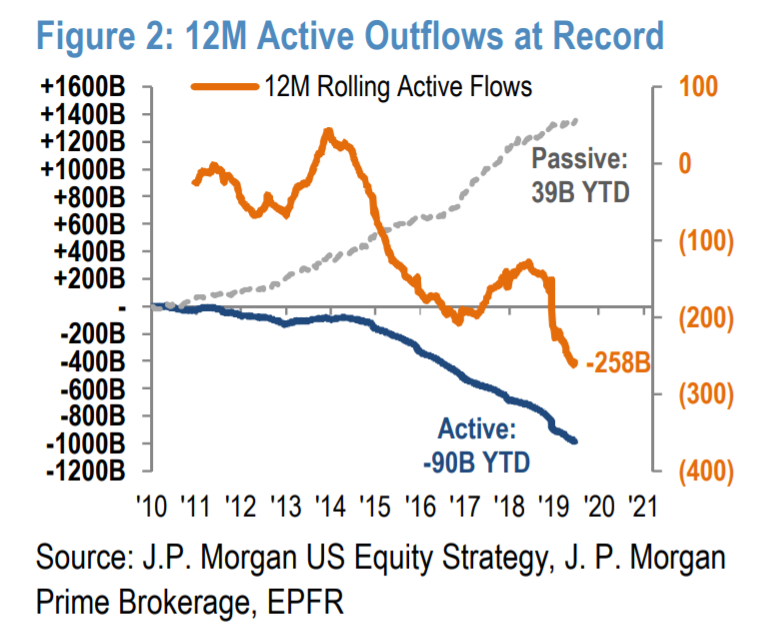

Nope. And pigs can't fly either, though I'm sure you could craft an articulate and enteraining argument for the consequences of flying pigs.... 1) Since 2002, passive investing has been outpacing active investing in terms of total market share of the stock market universe. This means on balance active investors have been selling to passive investors and active investors have been leaving the market. ...

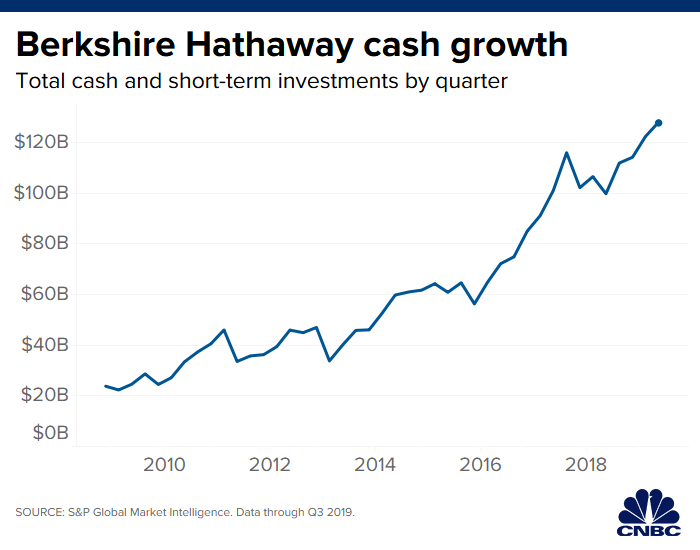

I don't know of any data that would support your first sentence and, really, retail investors are a tiny fraction of the market. Even if some of them are market-timing, the big boys are not.... 3) Active investors leave the market as when they feel values are too high they hold more cash and then under perform passive investing by ever great amounts, exacerbated by the ZIRP conditions leading to zero returns on their cash while passive indexes soar. Since 2011 this is leading to a hockey stick curve in the percentage of the market that passive investing controls. Presently about 90 percent of all transactions and 38 percent of the holders of equity capitalization. There has been an explosive increase in passive holdings over the past 8 years ...

Nope, that pig can't fly either. There is only one pool of stock. When I buy some VTWAX, Vanguard buys from the market. No one knows or cares whether the sellers had active or passive investment strategies.... 4) This means as passive funds continue to receive funds they must buy the index whatever the level of the index, and the reduced pool of active investors is lessening the pool from which to buy the stock. ...

Well, at best that is an unproven assertion. But more importantly, we retail investors far overestimate our effect on the market. It is the pension funds and insurance companies that drive the market. The net effect of retail investors' activity is in the roundoff error.... 5) Older investors are far more likely to hold active funds and investors younger than 30 hold nearly 90 percent of their equity in passive funds. ...

That's mathematical nonsense. The relationship between passive and active management performance is highly constrained. Here is the math:https://web.stanford.edu/~wfsharpe/art/active/active.htm... So the trend of passive investing is only going to increase, leading to wider price gains in order to break investors hold of their stocks. SO over the next 2 years passive will surpass the holdings of funds in the market to over 50%, further reducing the supply from active investors. And the passive indexes will most likely be performing far better than active managers and confirm in investors minds the need for passive investing. ...

Even if I buy your unproven assertion re % of holdings, it does not lead to a conclusion that volatility will increase. If the market goes up it will be because investors bid it up. That has been the case since the first Assyrian traded a dead squirrel for a cup of wheat. Mr. Market neither knows nor cares what the buyers' investing philosophies are. More will be passive than active, but so what? It is still the same investors buying from the same pool (US: 3600 stocks).... 6) Equity holdings as a percentage of a portfolio is also growing leading to more money being invested in the market and as passive investing will be driving up the indexes price moves will become more and more rapid. ...

That's a popular but implausible and completely unproven ghost story. It overlooks the fact that passive investors don't trade. Even holding the majority of the assets, stock-pickers will be doing the vast majority of trading, hence price discovery. And if the situation changes and some mispricing begins to occur, the stock pickers will be right there to remedy it....7) Once the passive market achieves more than 50% of the market, the lack of active managers is going to increasingly reduce the liquidity to the market ...

Wow! A whole herd of flying pigs! I'm outta here; it will be raining pig crap very soon.... The and move will become explosive, by the end 10-20 percent increase in a month will be seen. I expect something along the lines of a 30-35 percent gain followed by a 35-40 percent gain followed by a 90-100 percent gain will occur in stocks. ...

While reading the original post, I kept inserting "and this never has caused a disturbance where prices fell". Hmm. Less convincing.

What this presumes is that a company who's stock is not in the S&P will go for pennies on the dollar. Oh, but wait, people are buying "total market" indexes, so maybe not. Well, if it's pennies on the dollar, me and Fred are going to be buying the company LBO-style.

Yeah, the trade volume is dominated by high frequency traders/algorithms and other professional trading desks. These folks are probably trading on momentum or other quant measures that don’t require analysis of the underlying business for each specific stock.I am not certain the influence of "active" investors - those who trade among individual stocks - has declined at all. Even if index investments represent a larger fraction of ownership in the total market, the "activity" level could be increasing just as fast, manifested as changes in the lineup.

https://qz.com/1587963/how-the-sp-500-is-built-and-who-decides-what-companies-go-in-it/

By definition, the increasingly rapid turnover among individual S&P components can't be driven by indexers. The active investors are still steering the ship, only with directed thrust instead of a rudder.

It's a self-repairing process but the concern is based on the false premise that there is a risk the price discovery will stop happening. It won't, because passive investors' activity will never dominate trading.I do think that a very valid point you make is what the impact of passive investing is on price discovery. How can the market possibly be pricing in differences in the future prospects for companies if most people are just putting in money in a way that is blind to those differences? I get my mind all twisted around the axle trying to sort that out.

I guess I’ll be paying a lot of taxes and IRMAA because we’ll be rebalancing so much.

If CAPE10 crosses 40 again like in 1999, I’ll know we’re back in insanity land, whatever that means (bubble I guess).

mmmNope. And pigs can't fly either, though I'm sure you could craft an articulate and enteraining argument for the consequences of flying pigs. This is a violation of posting standards

The primary thing that has been happening is that investors who believe in stock-picking are realizing, in droves, that a passive strategy wins. For these investors it is not new money and there is no money flowing in or out of the market, it is just redeployment and in aggregate is it pretty much the same stocks being sold by stock pickers that are being bought by the passive funds that the investors are moving into. If you Google a bit you will find multiple stories about state pension funds that have made this move.

I am not stating that passive investing will not be profitable or that it is not winning, I am totally agreeing with that concept. However active management funds hold cash balances that index funds do not so even if only 2-3 percent, on margin additionally money is flowing into equities

A secondary thing is that new money coming into the market has predominantly gone into passive strategies.

But there is no data that I am aware of that says active investors are leaving the market. Simply looking at the funds flows leads to a contrary conclusion.

From Morningstar:

I don't know of any data that would support your first sentence and, really, retail investors are a tiny fraction of the market. Even if some of them are market-timing, the big boys are not.

I never used the term retail investor, I used the term passive investor and active investor, this can be retail, institutional or pension funds.

Re "hockey stick" and "explosive," of course not. What we are seeing is the first part of the typical S-curve found in every Marketing 101 textbook. The upper asymptote is unknown, of course, but my guess is 20-30% stays active. Depending on when you want to start counting, we have maybe 100,000 years of evolution that has favored optimists and risk takers in the gene pool. That's why the casinos and lotteries will never die. Further, DOL says there are about 1,000,000 people working in "the investment industry." The vast majority of that industry's income is based on the myth that stock picking works. Morgan Stanley's "Wealth Management" business, for one example, generates $3.5M of revenue an a net profit of over 25%. Between evolutionary fact and the vast resources of the investment industry, there is no prospect for a 100% passive scenario.

The issue occurs when passive surpasses active in the percentage of stocks due to the difference of liquidity people weighing the value of stocks versus investors selecting an asset class

Nope, that pig can't fly either. There is only one pool of stock. When I buy some VTWAX, Vanguard buys from the market. This is not true VANGUARD first nets across all their funds and buys or sells on a net basis in order to reduce costs, so purchases or sales are based on what the index pool as a whole does. No one knows or cares whether the sellers had active or passive investment strategies. The passive selling is done purely on the basis of cash flows to the index on a whole, nothing more and buying in total the equity in the index

Well, at best that is an unproven assertion. But more importantly, we retail investors far overestimate our effect on the market. It is the pension funds and insurance companies that drive the market. The net effect of retail investors' activity is in the roundoff error.

Again I never even spoke of retail investors

That's mathematical nonsense. The relationship between passive and active management performance is highly constrained. Here is the math:https://web.stanford.edu/~wfsharpe/art/active/active.htm

Sharpes' arguement is simply boiled down to this whatever percentage of the market that is passive the remainder is active and since passive owners own the whole market then active managers by definition must hold an equal percentage of each stock and they earn the same rates of return but passive investors pay lessor fees so they do better over time. But the methodologies and reasons for buying and selling differ. Again I am not arguing that passive investing will lead to a lessor performance, I agree that passive investing will over perform, I merely believe their is a large upward bias in the market coming over the next few years

Even if I buy your unproven assertion re % of holdings, it does not lead to a conclusion that volatility will increase. If the market goes up it will be because investors bid it up. That has been the case since the first Assyrian traded a dead squirrel for a cup of wheat. Mr. Market neither knows nor cares what the buyers' investing philosophies are. More will be passive than active, but so what? It is still the same investors buying from the same pool (US: 3600 stocks).

That's a popular but implausible and completely unproven ghost story. It overlooks the fact that passive investors don't trade. Even holding the majority of the assets, stock-pickers will be doing the vast majority of trading, hence price discovery. This is already patently untrue: passive investing presently accounts for 80% of all trades And if the situation changes and some mispricing begins to occur, the stock pickers will be right there to remedy it. This has been occurring and passive funds are buying the equities replacing active investors.

BTW, I think the 50% point has already been achieve and AFIK the sky is not falling. 50% is the percentage of mutual funds and ETF that are passive vs active, total assets is around 38% at the present time

Wow! A whole herd of flying pigs! I'm outta here; it will be raining pig crap very soon. More violations of posting standards, perhaps too much passive investing causing one to be overly active in posting

....

investing a little over 1% of my portfolio in a certain one year S&P500 call, if my prediction of a historic market does occur will expand to over 2 times the value of my entire portfolio, while limiting my loss to a little over 1% of the total value of my portfolio.

We do? I had never heard this before.Originally Posted by Running_Man View Post

as a matter of fact most individuals that invest in passive markets believe that markets are entirely predictable and expect prices to go ever higher, any low will be soon reversed and a new high achieved

I keep reading about how much money is out there and how government, corporate and consumer debt is at record highs. While all of this is true, for the life of me, I cannot figure out why we aren't suffering 1980's type inflation. Whoever has all that money isn't spending it on stuff. And whoever has all that debt isn't spending it on stuff. So where is it going?

Its going into financial assets (bond inflation driving $ into stocks).

Companies are borrowing to buy back stock vs. cap-ex that would translate to job/wage growth.

What are consumers spending money on? With record consumer debt and gobs of government spending, I would expect inflation. Something weird is going on.

Yes, please explain. Sounds crazy to me. Who doesn't know stocks go up and down (and even occasionally stay the same)?

IF you never stop investing in stocks and if price declines only make her better off than isn't that a defacto admission that your action show you believe stocks are going to go up, it is just a matter of the length of time until that view is correct, hasn't that view been proven by anyone that invested in US stocks prior to today?.

I've tutored my DD on investing, she understands and is contributing to a Target fund, 90% equities, and I showed her how things work. Shes even better off when the market goes down, she's buying cheap shares (but maybe losing value in any future inheritance!).

I'll study the opening post more later, but offhand, if all these passive investors are contributing with payroll deductions, or some occosional accumulated savings, why would they ever stop?

-ERD50

S&P500 presently out of the money by several hundred points.which specific 1 year call are you looking at?