flintnational

Thinks s/he gets paid by the post

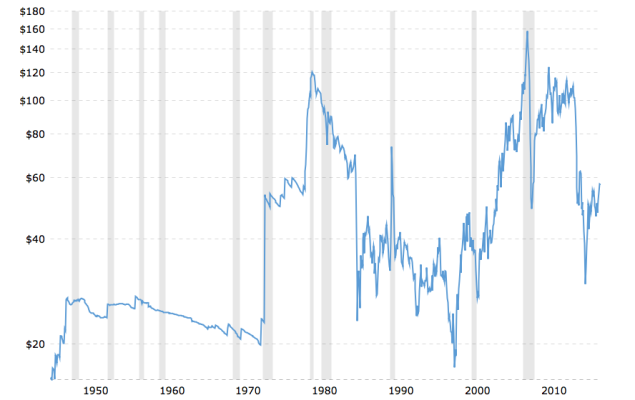

Many of us are buy and hold investors. And, we stick to our AA over long periods of time. But, I still try and gauge the value of different assets. If I find something cheap one day I might be a buyer. What is your opinion of asset prices? Please add other assets as you deem appropriate. Hey, we can always use another bitcoin thread.

US stocks - overvalued (maybe 20%)I expect strong earnings to continue for a while

International stocks - fairly valued

US Bonds - overvalued maybe in a bubble

Bitcoin - A game changing technology currently in a classic bubble

Housing - My area, Atlanta, is a strong sellers market but probably fairly priced

US stocks - overvalued (maybe 20%)I expect strong earnings to continue for a while

International stocks - fairly valued

US Bonds - overvalued maybe in a bubble

Bitcoin - A game changing technology currently in a classic bubble

Housing - My area, Atlanta, is a strong sellers market but probably fairly priced