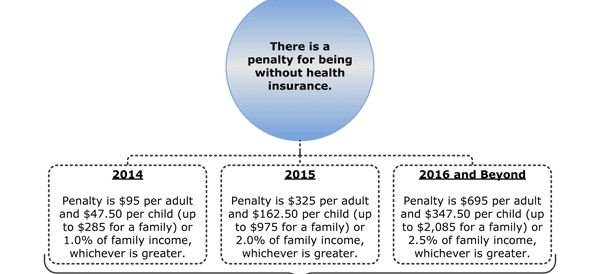

• Impose a tax on individuals without qualifying coverage of the greater of $695 per year up to a maximum of three times that amount or 2.5% of household income to be phased-in beginning in 2014.

• Exclude the costs for over-the-counter drugs not prescribed by a doctor from being reimbursed through an HRA or health FSA and from being reimbursed on a tax-free basis through an HSA or Archer Medical Savings Account. (Effective January 1, 2011)

• Increase the tax on distributions from a health savings account or an Archer MSA that are not used for qualified medical expenses to 20% (from 10% for HSAs and from 15% for Archer MSAs) of the disbursed amount. (Effective January 1, 2011)

• Limit the amount of contributions to a flexible spending account for medical expenses to $2,500 per year increased annually by the cost of living adjustment. (Effective January 1, 2013)

• Increase the threshold for the itemized deduction for unreimbursed medical expenses from 7.5% of adjusted gross income to 10% of adjusted gross income for regular tax purposes; waive the increase for individuals age 65 and older for tax years 2013 through 2016. (Effective January 1, 2013)

• Increase the Medicare Part A (hospital insurance) tax rate on wages by 0.9% (from 1.45% to 2.35%) on earnings over $200,000 for individual taxpayers and $250,000 for married couples filing jointly and impose a 3.8% tax on unearned income for higher-income taxpayers (thresholds are not indexed). (Effective January 1, 2013)

• Impose an excise tax on insurers of employer-sponsored health plans with aggregate values that exceed $10,200 for individual coverage and $27,500 for family coverage (these threshold values will be indexed to the consumer price index for urban consumers (CPI-U) for years beginning in 2020). The threshold amounts will be increased for retired individuals age 55 and older who are not eligible for Medicare and for employees engaged in high-risk professions by $1,650 for individual coverage and $3,450 for family coverage. The threshold amounts may be adjusted upwards if health care costs rise more than expected prior to implementation of the tax in 2018. The threshold amounts will be increased for firms that may have higher health care costs because of the age or gender of their workers. The tax is equal to 40% of the value of the plan that exceeds the threshold amounts and is imposed on the issuer of the health insurance policy, which in the case of a self-insured plan is the plan administrator or, in some cases, the employer. The aggregate value of the health insurance plan includes reimbursements under a flexible spending account for medical expenses (health FSA) or health reimbursement arrangement (HRA), employer contributions to a health savings account (HSA), and coverage for supplementary health insurance coverage, excluding dental and vision coverage. (Effective January 1, 2018)

• Eliminate the tax deduction for employers who receive Medicare Part D retiree drug subsidy payments. (Effective January 1, 2013)