Where might one find lists of suggested proposals (by credible sources) for fixing SS and Medicare? I've read what I have found on the net and the suggested modifications (TINY increases in taxes for the programs or tiny decreases in benefits) seem so slight that I'm not sure why the hullabaloo, yet I'm paranoid, given the fuss, that the programs may melt away in the next 20 years.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

proposals for fixing ss and medicare

- Thread starter palomalou

- Start date

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

I agree that the current cuts and proposed taxes are nothing compared to what's to come.

The fuss is all about can we support what has been promised, and what are we willing to give up to have what was promised. Evidently the current system is absolutely unsustainable. The programs won't melt away, they'll just become less generous and cover less.

A good compromise plan is the Simpson-Bowles presidential commission on deficit reduction report. Something like this is likely. But first we'll hear all the loud shouting/grandstanding.

www.fiscalcommission.gov/sites/.../TheMomentofTruth12_1_2010.pdf

The fuss is all about can we support what has been promised, and what are we willing to give up to have what was promised. Evidently the current system is absolutely unsustainable. The programs won't melt away, they'll just become less generous and cover less.

A good compromise plan is the Simpson-Bowles presidential commission on deficit reduction report. Something like this is likely. But first we'll hear all the loud shouting/grandstanding.

www.fiscalcommission.gov/sites/.../TheMomentofTruth12_1_2010.pdf

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Evidently they moved the report's location on their website:

try this link:

The Moment of Truth: Report of the National Commission on Fiscal Responsibility and Reform | National Commission on Fiscal Responsibility and Reform

try this link:

The Moment of Truth: Report of the National Commission on Fiscal Responsibility and Reform | National Commission on Fiscal Responsibility and Reform

Thanks to both! I read the applicable areas, and am not seeing why all the hue and cry yet, unless they hid the increase in medicare premiums and SS tax in language beyond me. I've been assuming that what we pay will have to increase and what we get will have to decrease. The figures I've read in other documents do not seem large in either category. I've been calculating a 25% decrease in SS benefits and planning 110K (2011 dollars) in our of pocket medical over 30 years.

Last edited:

ziggy29

Moderator Emeritus

In terms of how draconian the "solutions" to "fix" these things are concerned, SS only needs a tune-up. Medicare needs a complete overhaul.

Having said that, the recent threats to SS recipients that they "may not" receive their checks if the government defaulted shows just how illusory the "trust fund" really is.

Having said that, the recent threats to SS recipients that they "may not" receive their checks if the government defaulted shows just how illusory the "trust fund" really is.

Beryl

Recycles dryer sheets

- Joined

- Jun 20, 2007

- Messages

- 413

In terms of how draconian the "solutions" to "fix" these things are concerned, SS only needs a tune-up. Medicare needs a complete overhaul.

+1

I wish people would stop looking at SS for major changes and keep their grubby, greedy paws off of it.

Medicare needs a LOT of work but so does our entire healthcare system. Just overhaul the entire thing and provide Medicare for all.

*ducking*

meierlde

Thinks s/he gets paid by the post

Expect Medicare to go to the HMO model, where you go to their clinic, likley with a nurse practioner as the primary care giver. You will need a referral to see a specialist. We know the HMO model does cut costs, at the cost of not being able to self refer to a specialist.

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Palo: SS is not in such bad shape (assuming the taxpayers agree to make good on the trust fund). Even the worst case scenarios say we could alleviate problems with a 25% cut in benefits. The tension arrives because many people (me included) worry that a 25% cut would be devastating to all the people who rely on SS for the bulk of their retirement. So we look for additional revenues - e.g. raise the caps. But we are basically asking for the "OK off" and the "well off" to pick up that tab for the poor. That is socialism, plain and simple and that doesn't go over well for many. Hopefully (to me at least) we will compromise somewhere in the middle with modest cuts like those involving a different COLA scale and some new revenues. Medicare/Medicaid is another beast. But then so is our entire private sector approach to paying for health care.

toofrugalformycat

Full time employment: Posting here.

Responsed to original poster: I found this article today by Robert Reich, a former trustee of the SS Trust Fund, that seemed quite simple and clear, about why SS needs tweaking and how to do it:

Robert Reich: Budget Baloney: Why Social Security Isn't a Problem for 26 Years, and the Best Way to Fix It Permanently

"So there's no reason even to consider reducing Social Security benefits or raising the age of eligibility. The logical response to the increasing concentration of income at the top is simply to raise the ceiling."

Robert Reich: Budget Baloney: Why Social Security Isn't a Problem for 26 Years, and the Best Way to Fix It Permanently

"So there's no reason even to consider reducing Social Security benefits or raising the age of eligibility. The logical response to the increasing concentration of income at the top is simply to raise the ceiling."

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

... Evidently the current system is absolutely unsustainable. The programs won't melt away, they'll just become less generous and cover less.

A good compromise plan is the Simpson-Bowles presidential commission on deficit reduction report. Something like this is likely. But first we'll hear all the loud shouting/grandstanding.

www.fiscalcommission.gov/sites/.../TheMomentofTruth12_1_2010.pdf

Much of the stuff I have read is that SS is not the real problem... Medicare is and by larger extension the entire way healthcare is funded... just worth noting.

I am not so ready to just swallow the hook that a bunch of career politicians (the ones who got use here) throw out there.

The last time this funding debate for SS and Medicare happened was in the Reagan administration. They cut general taxes and increase FICA (to fix SS and Medicare) and it was spent the FICA income.

Now here we are again. They are throwing out 30 and 50 year projection (AGAIN) to distract people from the immediate issue.

The real issue is the need to begin paying back that $2.5T of FICA that they spent (NOW.. not 30 years out).

Nothing is dissolving... it is in more deliberate. You are looking at step 2. Was it concieved like that 30 years ago... of course not... but a crafty politician will seize on it and use the opportunity at hand.

Step 3 will occur before you exit the planet.

You had better believe that there are people (politicians, lobbyest, private citizens)that really want to kill those programs. Not all of them do... but they are there.

Here is their point of view: Well I wasn't successful at killing it. But half a loaf is better than none. And better yet, I actually convince them to believe it was in their interest to do it. I'll be back for the other half in another 15 years or so.

Here is what this game is... if you are willing to blink, they will seize the opportunity.

You... Yes you follow the rules... they broke their own rules and now they have to do something painful... what do they do... make new rules.

I don't know what you do for a living or how high you made it in your organization... if you have worked around people at a very high level (the top).... There is a lot of hubris because of their power and privileges that they assume to be a right. If you believe for a second that the leadership is not that calculating... you my friend are sadly mistaken. Of course they are not foolish enough to utter it... and for their own conscience (because after all, they would not go around scr3wing people) they rationalize it!

Show me any politician doing anything for 30 years down the road... Heck, that was the story the last time!!! 30 years has passed.

If you do not realize it... you are being asked to go along with not paying back that $2.5T. Because... it is due NOW!!!

Why, some don't want to increase taxes and they don't want to cut other programs (the other big programs are their pet programs or may not be able to balance the account).

Heck... if we are going to have to give up the money we paid for the last 30 years... we should at least recognize what is going to happen... We are getting scr3wed!

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1 Chinaco. Opponents of the New Deal and The Great society are that calculating and they have marched us up to the tipping point on achieving their goals.

Reich's "solution" doesn't cut it for several reasons. We hashed it out in this thread.Responsed to original poster: I found this article today by Robert Reich, a former trustee of the SS Trust Fund, that seemed quite simple and clear, about why SS needs tweaking and how to do it:

Robert Reich: Budget Baloney: Why Social Security Isn't a Problem for 26 Years, and the Best Way to Fix It Permanently

"So there's no reason even to consider reducing Social Security benefits or raising the age of eligibility. The logical response to the increasing concentration of income at the top is simply to raise the ceiling."

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

And here is the "Gang of 6" Proposal, that built off Erskine-Bowles http://www.washingtonpost.com/r/201...al-Politics/Graphics/Gang_of_Six_Document.pdf. Hopefully (inevitably) the new Special Commission will start with both works...

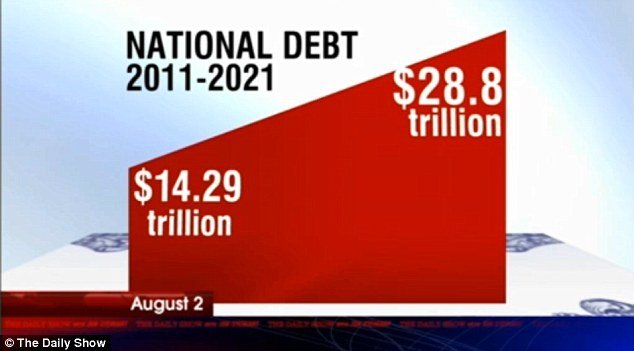

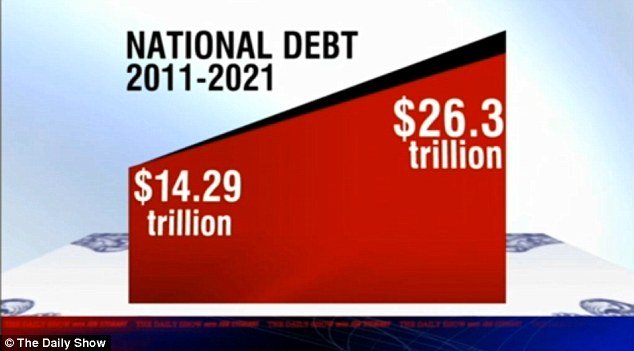

However, based on the agreement reached Monday, this is the impact of that agreement even after the Special Commission has done it's work. Evidently we're still kidding ourselves?

However, based on the agreement reached Monday, this is the impact of that agreement even after the Special Commission has done it's work. Evidently we're still kidding ourselves?

Attachments

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Chinico,

Taxes alone won't do it. It is inevitable that those entitlement programs will become less generous. One way or another it is going to happen. Oh taxes will go up, you can count on that. But no matter what rate they set it won't collect enough to cover entitlements

Midpack's chart shows the trend. Beyond 2011 things just keep getting worse quickly.

By the way, this isn't new. people have known about it for decades.

Taxes alone won't do it. It is inevitable that those entitlement programs will become less generous. One way or another it is going to happen. Oh taxes will go up, you can count on that. But no matter what rate they set it won't collect enough to cover entitlements

Midpack's chart shows the trend. Beyond 2011 things just keep getting worse quickly.

By the way, this isn't new. people have known about it for decades.

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

That projection looks a little high ($8T) compared to the CBO projections I saw for 2021 (before that debt deal).

What I saw was projecting around $20T. Which is still too much (IMO).

http://www.cbo.gov/ftpdocs/121xx/doc12130/04-15-AnalysisPresidentsBudget.pdf

What I saw was projecting around $20T. Which is still too much (IMO).

http://www.cbo.gov/ftpdocs/121xx/doc12130/04-15-AnalysisPresidentsBudget.pdf

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

Chinico,

Taxes alone won't do it. It is inevitable that those entitlement programs will become less generous. One way or another it is going to happen. Oh taxes will go up, you can count on that. But no matter what rate they set it won't collect enough to cover entitlements

Midpack's chart shows the trend. Beyond 2011 things just keep getting worse quickly.

By the way, this isn't new. people have known about it for decades.

Well... I did not say that taxes alone would do it.

But, taxes do not even seem to be in the (official) cards.... other than by default... the sunset of the Bush tax cut... which, you are correct... that will not do it.

I am still looking for some of that shared pain they have been talking about.

What it is looking like to me is mainly Middle Class Pain!

Well... I did not say that taxes alone would do it.

But, taxes do not even seem to be in the (official) cards.... other than by default... the sunset of the Bush tax cut... which, you are correct... that will not do it.

I am still looking for some of that shared pain they have been talking about.

While federal taxes as a percent of GDP are close to the postwar average now, total taxes (local, state, federal, see chart below) are already programmed to be at very high levels. Every new increment is going to reduce economic growth by taking investment money out of the private sector. And economic growth is the only way out of our mess.

toofrugalformycat

Full time employment: Posting here.

Reich's "solution" doesn't cut it for several reasons. We hashed it out in this thread.

Thanks for pointing that out. Sorry I missed that thread - I don't read all the threads. I won't continue on this line even though I disagree with the disagreement.

Beryl

Recycles dryer sheets

- Joined

- Jun 20, 2007

- Messages

- 413

chinaco said:Well... I did not say that taxes alone would do it.

But, taxes do not even seem to be in the (official) cards.... other than by default... the sunset of the Bush tax cut... which, you are correct... that will not do it.

I am still looking for some of that shared pain they have been talking about.

What it is looking like to me is mainly Middle Class Pain!

Agreed but the sad part as many who support continuing to hit the middle class are lower class citizens! For the life of me, I can figure out why they'd rather cause themselves more pain than to allow those tax cuts to expire on the rich.

Okay, I'll ask another closely related question: if Medicare is already more financially efficient than private insurance companies which are in business to make a profit, why would privatizing Medicare as proposed for those under 55 be anything except a further subsidy to big business? This is important to me because although I am over 55, my spouse is 53.

Last edited:

Beryl

Recycles dryer sheets

- Joined

- Jun 20, 2007

- Messages

- 413

palomalou said:Okay, I'll ask another closely related question: if Medicare is already more financially efficient than private insurance companies which are in business to make a profit, why would privatizing Medicare as proposed for those under 55 be anything except a further subsidy to big business? This is important to me because although I am over 55, my spouse is 53.

It wouldn't. Privatizing Medicare is as bad as privatizing firefighting and police. Some things should not have a profit component.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So you'd get a raise from the government, 'bribing you with your own money,' that's what politicians do for a living. You're right it doesn't make any sense in the long run, but have you seen anyone complain or object at any time this year? We get what we deserve...Can anyone rationally explain why on earth our wonderful politicians cut the SS tax by 2% this year when the system is on track to default. Holy cow, throw that drowning man a brick!

Similar threads

- Replies

- 53

- Views

- 6K

- Replies

- 21

- Views

- 1K