You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Scott Burns: Who stole the Social Security money?

- Thread starter serie1926

- Start date

- Status

- Not open for further replies.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Who Stole the SS money?

I'd say it was 'stolen' by voters who've continuoulsy chosen politicians proposing increased benefits of all kinds and tax cuts. Ulitmately the voters who have the longest voting history are mostly responsible for the 'sad state of affairs.'

It's important to remember the money that the govenrment spends doesn't get sucked through some black hole in space. It goes to people. People who vote.

So who 'stole the SS money?' We did!

P.S. According to CBO Social Security is underfunded by $6.5T. The $2.6T "trust fund" only covers about 29% of future obligations net of SS taxes. So not only did voters choose to spend the trust fund, they've also chosen to under tax themselves relative to the benefits they've promised themselves by a very large margin. Pretty irresponsible bunch these folks.

I'd say it was 'stolen' by voters who've continuoulsy chosen politicians proposing increased benefits of all kinds and tax cuts. Ulitmately the voters who have the longest voting history are mostly responsible for the 'sad state of affairs.'

It's important to remember the money that the govenrment spends doesn't get sucked through some black hole in space. It goes to people. People who vote.

So who 'stole the SS money?' We did!

P.S. According to CBO Social Security is underfunded by $6.5T. The $2.6T "trust fund" only covers about 29% of future obligations net of SS taxes. So not only did voters choose to spend the trust fund, they've also chosen to under tax themselves relative to the benefits they've promised themselves by a very large margin. Pretty irresponsible bunch these folks.

Last edited:

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Gone4Good;1107160P.S. said:According to CBO Social Security is underfunded by $6.5T. The $2.6T "trust fund" only covers about 29% of future obligations.

It all depends on how you count. The trust fund covers the difference between obligations and expected SS taxes. The CBO projection uses the most conservative of future growth projections. With better growth than the CBO estimate, the system doesn't look as bad as some say.

Nonetheless, As Scott Burns points out, SS is a side-show to the inevitable Medicare crisis/disaster. SS looks well funded compared to Medicare.

- Things are going to change for the worse. After all the moaning and speaches, downward changes are inevitable. The prudent FIREee should allow for such changes in their planning.

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

Might as well just move this on over to the political forum before the pig shows up.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Too late...Might as well just move this on over to the political forum before the pig shows up.

Attachments

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

..

P.S. According to CBO Social Security is underfunded by $6.5T. The $2.6T "trust fund" only covers about 29% of future obligations net of SS taxes. So not only did voters choose to spend the trust fund, they've also chosen to under tax themselves relative to the benefits they've promised themselves by a very large margin. Pretty irresponsible bunch these folks.

Because that $6.5T is a big figure... I want to put it into context.

This must be what you looked at or the article you cited.

http://www.ssa.gov/oact/tr/2011/tr2011.pdfFor the 75-year projection period, the actuarial deficit is 2.22 percent of taxable payroll, 0.30 percentage point larger than in last year’s report. The opengroup unfunded obligation for OASDI over the 75-year period is $6.5 trillion in present value and is $1.1 trillion more than the measured level of a year ago. If the assumptions, methods, starting values, and the law had all remained unchanged, the unfunded obligation would have risen to about $5.8 trillion due to the change in the valuation date.

It is a 75 year projection done this year up till 2086. Just to put that into context.... If it is the 75 year projection, to put that in context... If we went backward 75 years we would be in 1936, still in the grips of recovery from the great depression. Our cumulative PV GDP using current GDP ($14.2T) is $1065T.

Matter of fact, the CBO knows that those projection are really suspect and they wrote a paper on it.... the use of montecarlo simulations.

Their claim is that it improves their ability to project. The fact is, in 75 years we will be in an entirely different world. Ask any one... extrapolations are highly suspect and the further out one goes... the more suspect it is.

The analysis is useful, but at best a 75 year projection is really just Directional (on track/off track)!!! Don't believe me.. check with an actuary that does this sort of work.

http://www.cbo.gov/ftpdocs/68xx/doc6873/11-16-MonteCarlo.pdf

The proposal to adjust the program every 10 years is a good one IMO.

Last edited:

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

Scott Burns: Who stole the Social Security money? - Houston Chronicle

Sad state of affairs...

Thanks for posting the article. That Trust Fund money was used over the last 30 years to fund a huge tax cut for the extremely wealthy of the country. Now they do not want to pay it back in the form of general taxes.

If you have not figured it out that is what is cooking! The real issue is not increasing your FICA... The issue is about increasing FICA and general taxes on the wealthy and business... One item specifically the forgiveness of that $2.5T in trust fund debt (general tax obligation)!!!

The really bad part of this is that much of it will still fall right on the backs of the middle class... the middle class will wind up paying back that trust fund with general taxes... in effect being taxed to pay $2 for each original FICA $ with interest!

Middle class workers and retirees will pay! Remember most of the money retirees has saved has income tax due (accrued debt owed)!!! That GWB tax cut did not work for the majority of the middle class nor did the RR tax cut.

It is outrageous.

BTW - Those programs will not end... there is no way for them to end, it would throw our country into a real financial crisis... if you have not figure that out... retirees spend that money as it comes in.... it would severely affect the economy.

Last edited:

misanman

Thinks s/he gets paid by the post

- Joined

- Apr 28, 2008

- Messages

- 1,252

Who are "the wealthy?" Me? You?

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Isn't the middle class, along with everyone else, going to pay either way? Except...The real issue is not increasing your FICA... The issue is about increasing general taxes on business...

The really bad part of this is that much of it will still fall right on the backs of the middle class... the middle class will wind up paying back that trust fund with general taxes...

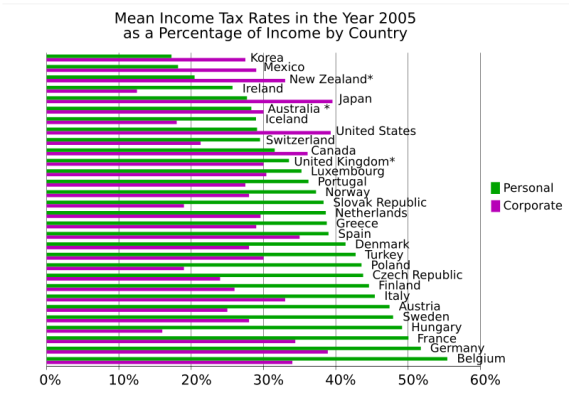

US Corp taxes are already among the highest in the world. Among other factors, that's already cost us millions of jobs that will never come back, and if anything may have accelerated since the recent great recession. If you increase taxes on US businesses, they will

- legally push more jobs offshore (been happening for decades) and/or

- you've increased their costs so they will pass them on as price increases (essentially a hidden tax on all consumers, largely the middle class)

All revenue ultimately comes from individuals, no where else. Unfortunately you might as well (reduce spending and) increase individual taxes on everyone, including the middle class. Everyone will bear about the same cost increase without further eroding our competitiveness vs other countries. Decreasing Corp taxes would ultimately improve our competitiveness - imagine that!

Increasing taxes on Corp is not the silver bullet some would like to believe, just the opposite actually...

Attachments

Last edited:

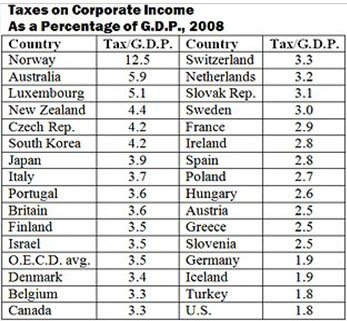

The data shows high tax rates but low taxes paid by US corporations. See the analysis by Bruce Bartlett hereUS Corp taxes are already among the highest in the world. Among other factors, that's already cost us millions of jobs that will never come back, and if anything may have accelerated since the recent great recession.

Attachments

Last edited:

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,265

The data shows high tax rates but low taxes paid by US corporations. See the analysis by Bruce Bartlett here

I have not read the analysis.... but looking at the graph it shows 2008... I think that is a bad year to pick since I am sure there were a lot of corporations that got back money from prior years on the losses they had for the year... you can request a refund of prior taxes paid... not sure that is available in other countries....

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Both evidently tax/GDP but wildly different numbers, and both from OECD & NYT, what am I missing?

Michael B: And so you contend that higher Corp tax rates won't result in higher prices to consumers or more US jobs offshore?

And if you look at the graph above, it would appear that individuals in the US aren't doing their fair share relative to most other countries (green bars). Evidently we're not paying nearly enough, the superrich, rich, middle class and everyone else should be paying more. Isn't that fascinating...

Michael B: And so you contend that higher Corp tax rates won't result in higher prices to consumers or more US jobs offshore?

And if you look at the graph above, it would appear that individuals in the US aren't doing their fair share relative to most other countries (green bars). Evidently we're not paying nearly enough, the superrich, rich, middle class and everyone else should be paying more. Isn't that fascinating...

Attachments

Last edited:

I saw your first chart as tax rates. Not the same thing as taxes paid, so I posted a chart based on taxes paid.Both evidently tax/GDP but wildly different numbers, and both from OECD & NYT, what am I missing?

I posted a chart and a link to the source and expressed no opinion.Michael B: And so you contend that higher Corp tax rates won't result in higher prices to consumers or more US jobs offshore?

Discussion about fair share, taxes, classes and such, all together, usually ends badly.And if you look at the graph above, it would appear that individuals in the US aren't doing their fair share relative to most other countries (green bars). Evidently we're not paying nearly enough, the superrich, rich, middle class and everyone else should be paying more. Isn't that fascinating...

I've read Scott Burns in the past and found him to be mostly helpful. The column referenced in the original post is provocative, the terminology aggressive and the tone very political. This is a different Scott Burns and not an improvement.

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

http://www.early-retirement.org/forums/attachment.php?attachmentid=12571&d=1314885349

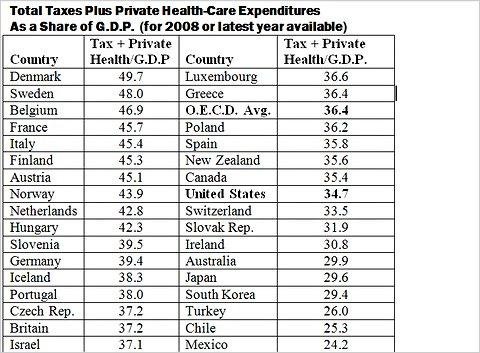

We see comparisons like this often. They don't include state and local and other taxes so they don't mean much. If they would do that the picture would be quite different.

I supose the goal of charts like this is to make us (wrongly) think we are undertaxed. These type charts are often from someone with a political agenda to push.

http://www.early-retirement.org/forums/attachment.php?attachmentid=12571&d=1314885349

We see comparisons like this often. They don't include state and local and other taxes so they don't mean much. If they would do that the picture would be quite different.

I supose the goal of charts like this is to make us (wrongly) think we are undertaxed. These type charts are often from someone with a political agenda to push.

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

Isn't the middle class, along with everyone else, going to pay either way? Except...

....

Sure. At a Macro level and in total for all expenditures.

I don't have a problem with shared pain so to speak....

But I am not happy about shifting the majority of the pain on to the middle class. Some would do that.

Part of the problem is lumping all of these programs into one massive debate.... It makes SS and Medicare vulnerable to shifting funds from it to other programs... as lobbyist move aggressively to protect their constituents. I don't have any lobbyist looking out for me... nor do you.

SS and Medicare are extremely important to all of us.

Many people do not understand how they are linked to their current company based programs. For one... there would be not corporate retirement health insurance if it was not backstopped by Medicare.

Who has insurance at 70 without some sort of government based backstop. The answers is very very few. Nobody I know.

The issues are broad and interlinked with many many other issues.

If anyone was really interested in fixing these issues, we would be headed toward some sort of health care fix.

The reality... most people that are interested in reducing SS and Medicare think it is in their personal interest to do it. The majority of people are wrong. They just don't know it. They have miscalculated their personal situation and their personal risk.

Added: but I do believe the system needs to be fair and self sustaining.

Last edited:

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

With regards to entitlements, we can either screw the younger folks now (55 or under), or we can screw everybody in 10 years. As someone under 55, I would rather bit the bullet now than pay in another 10 years and Uncle Sam give me the Soup Nazi treatment with austerity programs.......

We won't need the SS pension, we could sure use Medicare someday............

We won't need the SS pension, we could sure use Medicare someday............

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

With regards to entitlements, we can either screw the younger folks now (55 or under), or we can screw everybody in 10 years....

Wait.. are you talking about 1983... it took 30 years for that one to surface.

Hopefully the goal will be to not scr3w anyone.

Last edited:

Who are "the wealthy?" Me? You?

Anyone who has more money than me.

We see comparisons like this often. They don't include state and local and other taxes so they don't mean much. If they would do that the picture would be quite different.

I supose the goal of charts like this is to make us (wrongly) think we are undertaxed. These type charts are often from someone with a political agenda to push.

I agree, it is misleading as to total taxes, the whole picture is much more involved.

Liviing in the UK this last 6 months has reminded me of all the extra taxes here. National sales tax (20%), gas taxes, alcohol and tobacco taxes, National Insurance tax, Property tax, Local Council tax, TV licence, and road tax, and these are just some of them that I know are much higher than I ever paid in Texas and Louisiana.

Plus there are far less tax breaks available. e.g. No allowances for charitable contributions or mortgage interest, and nothing like the amount you can put away in tax advantaged retirement accounts. Few people are required to file tax returns because the tax code is pretty simple compared to the USA, with taxes on dividends, capital gains, interest etc all paid at source before you receive the proceeds.

Yep, that's all it was used for. We didn't fight a few wars, we didn't spend a bunch of money in a "stimulus" program, nobody got any food stamps or government benefits. Every nickel of SS overpayments went to tax cuts, and every bit of the tax cut went to the wealthy.Thanks for posting the article. That Trust Fund money was used over the last 30 years to fund a huge tax cut for the extremely wealthy of the country.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Yep, that's all it was used for. We didn't fight a few wars, we didn't spend a bunch of money in a "stimulus" program, nobody got any food stamps or government benefits. Every nickel of SS overpayments went to tax cuts, and every bit of the tax cut went to the wealthy.

Here's where the NYT says the money went over the past decade.

Attachments

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Every nickel of SS overpayments went to tax cuts, and every bit of the tax cut went to the wealthy.

That's just not true. Everyone who pays income taxes received a tax-cut. percentage-wise it was all about a 10 percent cut. If you are a high income type person then your ~10 percent is more than someone who hardly pays any tax.

Percentage-wise the less-affluent people did better than the affluent.

It's just math.

This thread has run its course

Porky Pig Cartoon Ending "That's All Folks!" - YouTube

Porky Pig Cartoon Ending "That's All Folks!" - YouTube

- Status

- Not open for further replies.

Similar threads

- Replies

- 194

- Views

- 7K

- Replies

- 1

- Views

- 364

- Locked

- Replies

- 127

- Views

- 7K

- Replies

- 6

- Views

- 1K