"I want my spouse to have a solid financial foundation in her twilight years after I am gone.

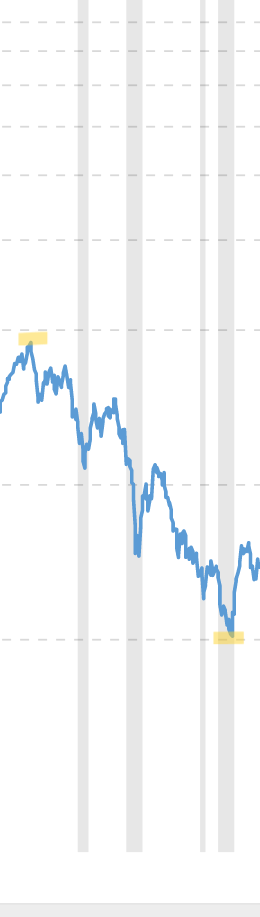

Therefore I plan to collect social security as early as possible and dump that income into an index fund. This will help avoid the virtually guaranteed loss that delayed Social Security offers for the first 25+/- years.

Upon my death, she will have a giant pile of cash and a monthly social security income stream that together are worth more than if I delayed collecting Social Security, providing the greatest spousal survivor benefit."

See full Article:https://www.gocurrycracker.com/why-early-social-security-provides-the-greatest-spousal-benefit/

Therefore I plan to collect social security as early as possible and dump that income into an index fund. This will help avoid the virtually guaranteed loss that delayed Social Security offers for the first 25+/- years.

Upon my death, she will have a giant pile of cash and a monthly social security income stream that together are worth more than if I delayed collecting Social Security, providing the greatest spousal survivor benefit."

See full Article:https://www.gocurrycracker.com/why-early-social-security-provides-the-greatest-spousal-benefit/