SS has strayed so far from its original path that it has indeed become an increasingly problematic de facto social welfare program. A far cry from what Pres Roosevelt CLEARLY envisioned to be a self-funded RETIREMENT program separate from other gov't welfare programs.

-SS Benefits were to be based on payroll tax contributions that the worker made during his/her working life. (e.g. Soc Sec ACCOUNT Number linked that worker to his/her contributions & future benefits)

-The significance of the new social insurance program was that it sought to address the long-range problem of economic security for the aged through a contributory system in which the

workers themselves contributed to their own future retirement benefit by making regular payments into a joint fund. It was thus distinct from the welfare benefits provided under Title I of the Act and from the various state "old-age pensions." As President Roosevelt conceived of the Act, Title I was to be a temporary "relief" program that would eventually disappear as more people were able to obtain retirement income through the contributory system.

from--

Social Security History

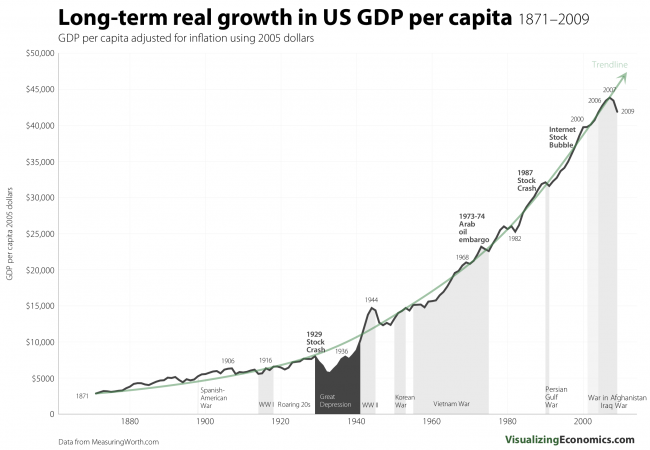

Of course any economic issue (inc taxation) must be interpreted differently in 21st century vs early 1930's. Economic globalization has made it easier for the ultra-wealthy to legally move huge income & capital internationally to meet economic challenges- inc changing tax burdens. Individuals & corporations clearly vary their behavior with major changes in tax policy. Consider consequences of recent major "tax the rich" moves in France-

Actor Gerard Depardieu joins French tax exiles in Belgium | News | The Week UK

It would be logical to assume such reactions would occur (again) in the US with similar tax law changes. Despite indicated top income tax rates varying from 28-90% over post WWII era, US population paid similar rates of overall ACTUAL total Fed tax revenues of ~17-18% of GDP.

Historical Tables | The White House (Table 2.3 download as XLS)

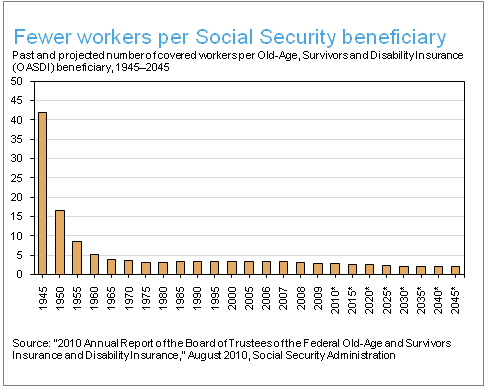

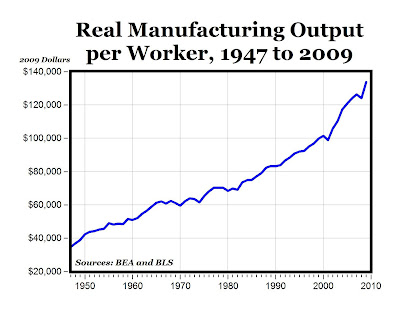

Clearly US SS is not sustainable without significant program changes, but durable solutions are most likely to come from tweaks in both revenue and benefits.