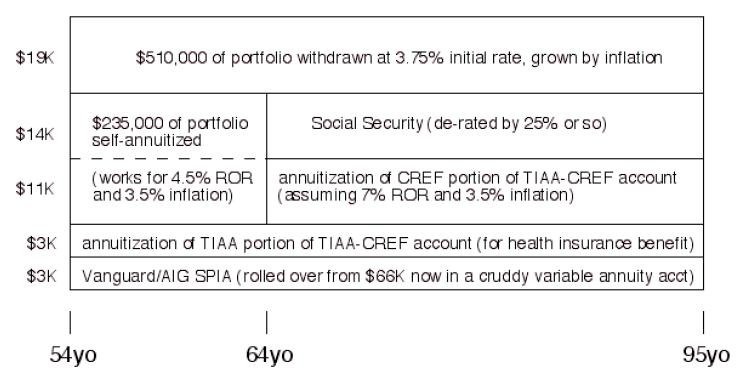

I have been thinking about draw-down of portoflios a lot, and how that fits in

with Social Security, pension annuites, and such; so I created the attached

drawing (plan_payout.pdf). I find it a helpful way to keep things straight in

my head, and I hadn't seen it before in my short time at this stuff.

I imagine the various blocks could be further subdivided into taxable and

tax-advantaged portions in order to better see how the tax-dance will work

out. Maybe it can be put into a spreadsheet so that blocks self-compute

as you change their sizes ...

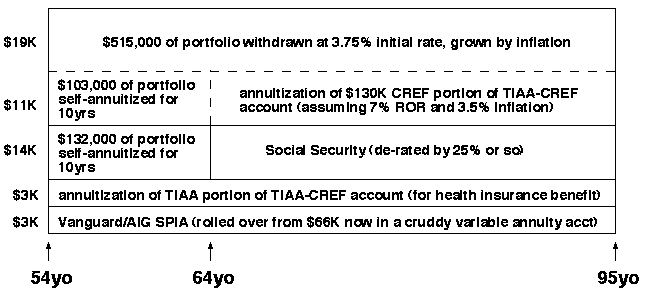

with Social Security, pension annuites, and such; so I created the attached

drawing (plan_payout.pdf). I find it a helpful way to keep things straight in

my head, and I hadn't seen it before in my short time at this stuff.

I imagine the various blocks could be further subdivided into taxable and

tax-advantaged portions in order to better see how the tax-dance will work

out. Maybe it can be put into a spreadsheet so that blocks self-compute

as you change their sizes ...