Urchina

Full time employment: Posting here.

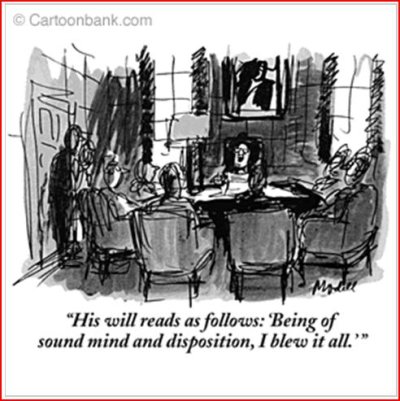

Sadly, my husband is about to become a first-time estate executor, as his dad passed away unexpectedly and suddenly this week.

We're in the process of collecting and gathering his dad's financial information, figuring out what he had and where it was. I'm wondering if anyone here has advice to give about practical things to do in the first couple of weeks after someone passes away.

I particularly liked Want2Retire's post about advice for executors, but it'll come in handy as probate for the estate begins. I'm looking for more ideas for smoothing the pre-probate process.

I'm especially curious if anyone has had experience with settling a multi-country estate, as my FIL was married to a non-US-national and lived in South America. So he has assets in both the US and his country of abode.

We are fortunate to have a competent and trusted CPA, and I'm working on finding us a probate attorney with international experience, should we need it.

Thanks in advance for any advice.

We're in the process of collecting and gathering his dad's financial information, figuring out what he had and where it was. I'm wondering if anyone here has advice to give about practical things to do in the first couple of weeks after someone passes away.

I particularly liked Want2Retire's post about advice for executors, but it'll come in handy as probate for the estate begins. I'm looking for more ideas for smoothing the pre-probate process.

I'm especially curious if anyone has had experience with settling a multi-country estate, as my FIL was married to a non-US-national and lived in South America. So he has assets in both the US and his country of abode.

We are fortunate to have a competent and trusted CPA, and I'm working on finding us a probate attorney with international experience, should we need it.

Thanks in advance for any advice.