TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

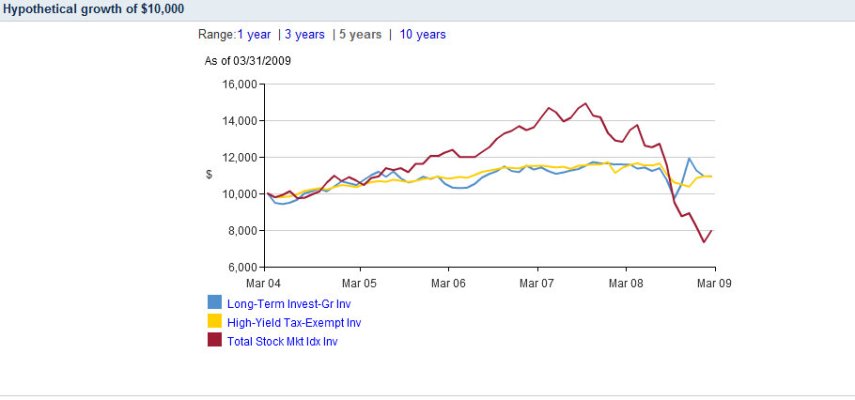

A complaint about the recent downturn is that not only did stocks do poorly, but bonds also declined.

However, looking at the chart below, it seems that that is no longer the case (that is, since the beginning of the year, bonds have recovered well). Am I reading things correctly?

However, looking at the chart below, it seems that that is no longer the case (that is, since the beginning of the year, bonds have recovered well). Am I reading things correctly?