Earl E Retyre

Full time employment: Posting here.

- Joined

- Jan 1, 2010

- Messages

- 541

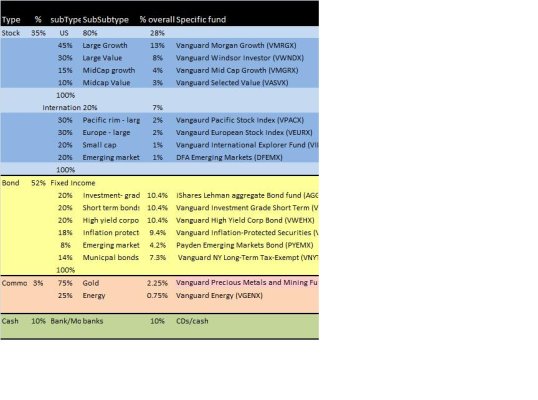

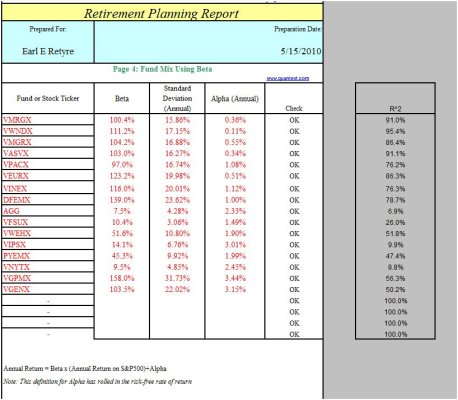

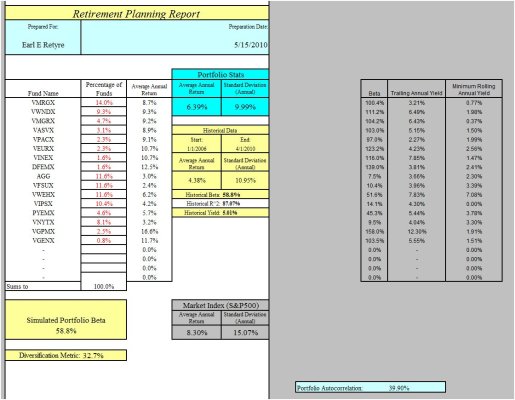

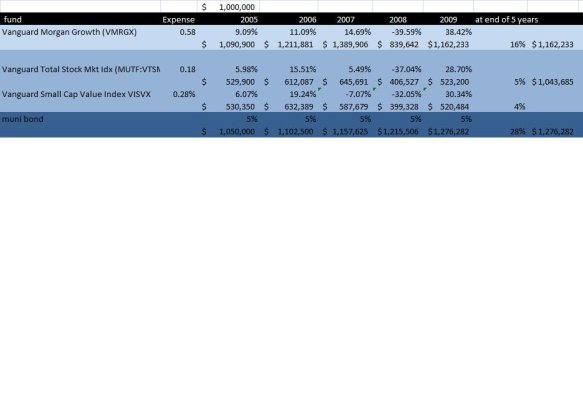

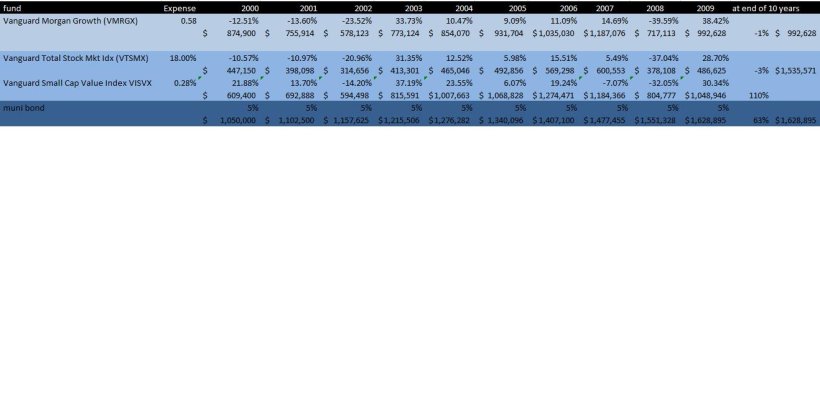

Based on advice from this forum I read the book, “All about Asset allocation” (good book) and also decided not to pay an expensive financial advisor. Looking at my options for diversification and one option is to simply put the money in Vanguard Wellesly and let Vanguard rebalance for me. Seems like many on this forum may do that. The other is to create my own diversified portfolio. Taking an initial stab at the latter (and choosing low cost funds, mainly Vanguard) I came up with the table attached. Note: if I were to build my own portfolio I would call Vanguard and get some free advice first.

In comparing Wellsley performance over the last 3 years versus this portfolio and it is more or less the same.

Questions:

(1) Is it worth it to build your own portfolio to be much more diversified than Wellsley and to be more in control?

(2) Does the portfolio I created make sense?

(hopefully my attachment works and you can see it)

In comparing Wellsley performance over the last 3 years versus this portfolio and it is more or less the same.

Questions:

(1) Is it worth it to build your own portfolio to be much more diversified than Wellsley and to be more in control?

(2) Does the portfolio I created make sense?

(hopefully my attachment works and you can see it)