Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

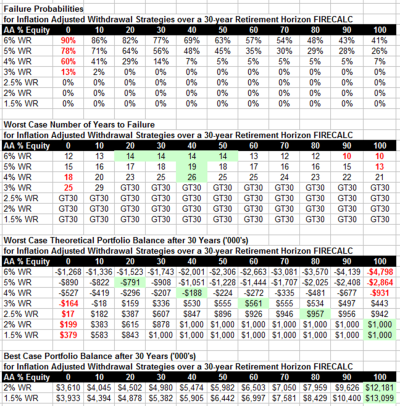

With the 'what to do when you've won the game' and 'why risk anything on equities' discussions lately, I plug-n-chugged numbers through FIRECALC to satisfy my own curiousity (attempting to emulate an article by Wade Pfau). No surprises re: WRs of 4% or above, maybe re: lower WRs? Beyond that I won't attempt to draw conclusions (this time), though there may be insights here regarding:

It's worth remembering this is all worst case based on past history, in the spirit of giving greater weight to fear of portfolio failure over more upside than most of us could ever hope to spend (aka marginal utility).

I expect the audience for this is small, might be only one...

Notes:

- I used FIRECALC (so using past data), 30 yrs starting with $1MM and spending per WRs shown.

- I used the Total Market Portfolio and simply varied the % equity allocation.

- I left Fixed Income as-is. Different Fixed Income strategies will definitely influence the results, but will they fundamentally change them? IOW, is there an actual fixed income/no equity mix that has ever actually outperformed the optimal fixed income/with equity AA from 1871 thru present - even at (very) low WRs?

- portfolio duration vs % equity

- effective withdrawal rates required to avoid depleting principal

- what AA has been safest even at low WR's

- the potential upside equities offer at low WR's without bringing on failure

It's worth remembering this is all worst case based on past history, in the spirit of giving greater weight to fear of portfolio failure over more upside than most of us could ever hope to spend (aka marginal utility).

I expect the audience for this is small, might be only one...

Notes:

- I used FIRECALC (so using past data), 30 yrs starting with $1MM and spending per WRs shown.

- I used the Total Market Portfolio and simply varied the % equity allocation.

- I left Fixed Income as-is. Different Fixed Income strategies will definitely influence the results, but will they fundamentally change them? IOW, is there an actual fixed income/no equity mix that has ever actually outperformed the optimal fixed income/with equity AA from 1871 thru present - even at (very) low WRs?

Attachments

Last edited:

]

]