RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

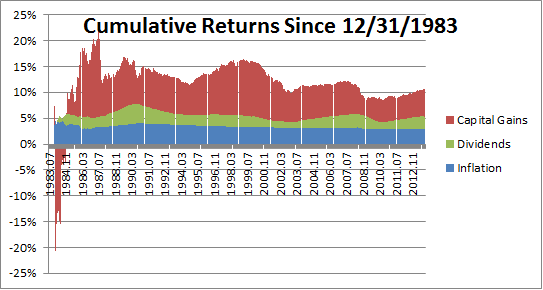

When you hear the term correction most think stocks falling back a bit. I think stocks were undervalued after the 2008 fall. Now with the big 2013 gain they have "corrected" back to where they should be.

Expect stock portfolios to double every 8 or 9 years from here (as usual).

Expect stock portfolios to double every 8 or 9 years from here (as usual).