audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

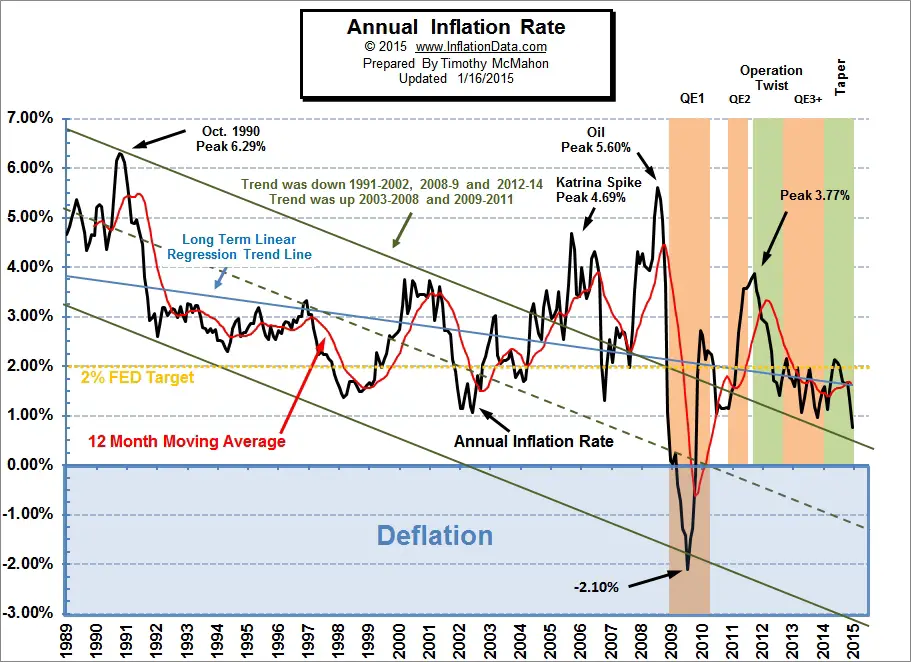

About this time annually, I usually review the real returns of my investments and net worth. I took a look at the recent three years of CPI-U inflation data today:

2014 inflation - 0.76%

2013 inflation - 1.50%

2012 inflation - 1.74%

Cumulative inflation over those three years - 4.05%

Man, inflation is low and still dropping! The annual number for 2014 is incredible.

Data is from InflationData.com's Cumulative Inflation Calculator

2014 inflation - 0.76%

2013 inflation - 1.50%

2012 inflation - 1.74%

Cumulative inflation over those three years - 4.05%

Man, inflation is low and still dropping! The annual number for 2014 is incredible.

Data is from InflationData.com's Cumulative Inflation Calculator