lwp2017

Recycles dryer sheets

- Joined

- Feb 10, 2014

- Messages

- 157

I told my company's leadership in January that I was retiring at 55 this summer. So they could plan for my succession.

They asked me to delay retiring and negotiated with me. Delaying would result in over $250,000 increase into retirement assets if I keep working until Feb 2018.

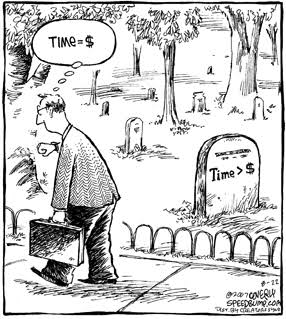

I wish my depression-era dad was still alive to talk it through, He retired at 61. He balanced money and quality of life rather well.

So I'm asking this forum for your advice.

I've read the stickies, posts, and other links.

After 30+ years of working hard being my family's sole provider it's very hard to walk away from that much money. We don't really need it though. I tell myself only nine more months, we could gift to the grandkids 529s, donate to our church building fund, start Roth IRAs for our kids, etc, etc.

My job is high stress, high pressure, often 6 days a week, well compensated at mid 6 figures. Quality of life is very poor. I work at a 7/24/365 business -for the past 30 years.

I would much rather be retired working on the small farm we live on. Finally spend time enjoying life which kinda feels selfish.

Also wanted quality time to rebuild my health and lose 40 pounds. No other health issues other than being too fat.

We have a frugal lifestyle, DW's favorite meal is still home cooked pinto beans, LOL.

No debt for over 20 years. If we want something expensive, we plan and save for it. Did a complete remodel on home, along with new roof, and all new fences on farm in past 2 years prior to retirement so no major expenses on the 20 year horizon other than autos and appliances.

Retirement in May would be over $11,000 per month from a defined benefit pension, before taxes. Also will receive $1200/month health care purchase supplement. We have saved $2.5M in 401K & brokerage investments.

So we have been blessed, money should be okay, I don't plan on cutting dryer sheets in half.

Both kids are launched, with jobs and also live modestly, debt free, in their own small homes.

DW taught school for about 10 years total but was mostly a stay at home mom. She truly loves her community volunteer work and is encouraging me to retire.

I do appreciate insight from any of of you that had a similar situation.

Just writing this question is somewhat cathartic.

Thanks!

They asked me to delay retiring and negotiated with me. Delaying would result in over $250,000 increase into retirement assets if I keep working until Feb 2018.

I wish my depression-era dad was still alive to talk it through, He retired at 61. He balanced money and quality of life rather well.

So I'm asking this forum for your advice.

I've read the stickies, posts, and other links.

After 30+ years of working hard being my family's sole provider it's very hard to walk away from that much money. We don't really need it though. I tell myself only nine more months, we could gift to the grandkids 529s, donate to our church building fund, start Roth IRAs for our kids, etc, etc.

My job is high stress, high pressure, often 6 days a week, well compensated at mid 6 figures. Quality of life is very poor. I work at a 7/24/365 business -for the past 30 years.

I would much rather be retired working on the small farm we live on. Finally spend time enjoying life which kinda feels selfish.

Also wanted quality time to rebuild my health and lose 40 pounds. No other health issues other than being too fat.

We have a frugal lifestyle, DW's favorite meal is still home cooked pinto beans, LOL.

No debt for over 20 years. If we want something expensive, we plan and save for it. Did a complete remodel on home, along with new roof, and all new fences on farm in past 2 years prior to retirement so no major expenses on the 20 year horizon other than autos and appliances.

Retirement in May would be over $11,000 per month from a defined benefit pension, before taxes. Also will receive $1200/month health care purchase supplement. We have saved $2.5M in 401K & brokerage investments.

So we have been blessed, money should be okay, I don't plan on cutting dryer sheets in half.

Both kids are launched, with jobs and also live modestly, debt free, in their own small homes.

DW taught school for about 10 years total but was mostly a stay at home mom. She truly loves her community volunteer work and is encouraging me to retire.

I do appreciate insight from any of of you that had a similar situation.

Just writing this question is somewhat cathartic.

Thanks!

Last edited: