kannon

Recycles dryer sheets

Morning -

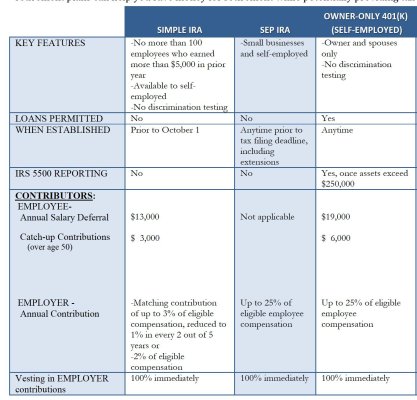

Oldest son is self employed, receives numerous 1099s. He has his own Roth IRA that he maxes out. Looking for other opportunities to save for retirement.

I suggested look into an Individual 401K from Vanguard. Anyone doing this?

My main questions are:

1) can he have an Individual 401K AND a Roth IRA?

2) what are the limits? % of net profit or hard number like employer 401k plans?

3) when can he contribute? Is 31 Dec the end for contributing to a 2018 individual 401k?

4) How? Vanguard is what we use now. They have a 102 page Individual 401K guide. Yikes!!

5) any words of wisdom??

Many thanks

Kannon

Oldest son is self employed, receives numerous 1099s. He has his own Roth IRA that he maxes out. Looking for other opportunities to save for retirement.

I suggested look into an Individual 401K from Vanguard. Anyone doing this?

My main questions are:

1) can he have an Individual 401K AND a Roth IRA?

2) what are the limits? % of net profit or hard number like employer 401k plans?

3) when can he contribute? Is 31 Dec the end for contributing to a 2018 individual 401k?

4) How? Vanguard is what we use now. They have a 102 page Individual 401K guide. Yikes!!

5) any words of wisdom??

Many thanks

Kannon