You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading American Fund Mutual Funds within Fidelity

- Thread starter augam

- Start date

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have American in my 401K and it should cost you nothing except tax consequences, if in a taxable account.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

The fee would depend on the custodian of your rollover IRA. Better check with them.

Years ago, I bought a MF for an account with Schwab. The transaction fee for trading stocks was expensive then, but only $12.9 or something. The MF transaction was a lot higher, like $50 or something. I was shocked, assuming it was the same as for stocks. Not making the same mistake again. I could have bought that MF in an account with another brokerage.

In your case, you already have money with them. So, check with them.

Years ago, I bought a MF for an account with Schwab. The transaction fee for trading stocks was expensive then, but only $12.9 or something. The MF transaction was a lot higher, like $50 or something. I was shocked, assuming it was the same as for stocks. Not making the same mistake again. I could have bought that MF in an account with another brokerage.

In your case, you already have money with them. So, check with them.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Nowaways, employers use an outside financial service company to handle 401k. My wife's megacorp currently uses Wells Fargo. Another megacorp of mine uses Fidelity.

You should have received periodic mailings from the 401k custodian, or you go on their Web site to know about your 401k balance and its holding.

If it is something like a company-sponsored custodian like my wife's 401k, then there is usually no transaction fee.

I thought you were talking about a detached custodian when you rollover the IRA, such as Schwab, or TD-Ameritrade, etc...

You should have received periodic mailings from the 401k custodian, or you go on their Web site to know about your 401k balance and its holding.

If it is something like a company-sponsored custodian like my wife's 401k, then there is usually no transaction fee.

I thought you were talking about a detached custodian when you rollover the IRA, such as Schwab, or TD-Ameritrade, etc...

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

Yeah, you should be able to do that. Fidelity can tell you for sure and the costs. I'd recommend you research some of Fidelity's cheaper index funds that will perform, arguably, as well and save ~.45 on your fees.Trying to figure out what it will cost to exchange mutual funds within the American Funds or go to cash or both.

Has anyone done this.

Thanks

Unless you're in love with American Funds there's no good reason to stay there. Far better, safer, cheaper, places to invest. AFS had their day, it happened in the spring of 1988.

The fee would depend on the custodian of your rollover IRA. Better check with them.

Years ago, I bought a MF for an account with Schwab. The transaction fee for trading stocks was expensive then, but only $12.9 or something. The MF transaction was a lot higher, like $50 or something. I was shocked, assuming it was the same as for stocks. Not making the same mistake again. I could have bought that MF in an account with another brokerage.

In your case, you already have money with them. So, check with them.

Nowaways, employers use an outside financial service company to handle 401k. My wife's megacorp currently uses Wells Fargo. Another megacorp of mine uses Fidelity.

You should have received periodic mailings from the 401k custodian, or you go on their Web site to know about your 401k balance and its holding.

If it is something like a company-sponsored custodian like my wife's 401k, then there is usually no transaction fee.

I thought you were talking about a detached custodian when you rollover the IRA, such as Schwab, or TD-Ameritrade, etc...

Yeah, you should be able to do that. Fidelity can tell you for sure and the costs. I'd recommend you research some of Fidelity's cheaper index funds that will perform, arguably, as well and save ~.45 on your fees.

Unless you're in love with American Funds there's no good reason to stay there. Far better, safer, cheaper, places to invest. AFS had their day, it happened in the spring of 1988.

Thanks to all for the responses.

Agreed regarding better investment opportunity hence the reason for my thoughts and Q's regarding the transaction fees.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Ah, I missed the headline of your thread. I often commit this error when reading too fast.

You said "MF within Fidelity", so of course Fidelity is your custodian. Sorry for the confusion.

Sorry for the confusion.

You said "MF within Fidelity", so of course Fidelity is your custodian.

Sorry for the confusion.

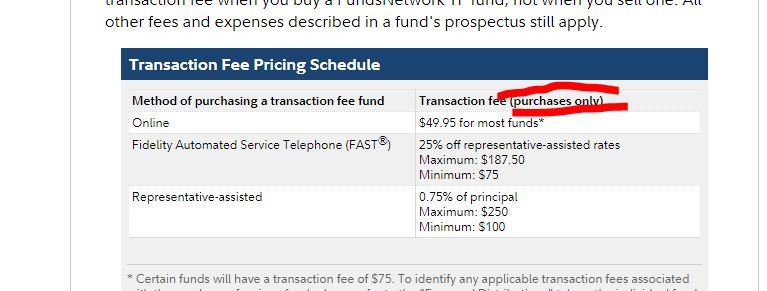

Sorry for the confusion.Here is a description of Fidelity fees

https://www.fidelity.com/mutual-funds/all-mutual-funds/fees

American funds don’t look like they are part of the No transaction fee program.

I think the transaction fees are usually applied on the purchase of the fund but not on the sale. If there is a fee it would likely be 49.95.

https://www.fidelity.com/mutual-funds/all-mutual-funds/fees

American funds don’t look like they are part of the No transaction fee program.

I think the transaction fees are usually applied on the purchase of the fund but not on the sale. If there is a fee it would likely be 49.95.

Here is a description of Fidelity fees

https://www.fidelity.com/mutual-funds/all-mutual-funds/fees

American funds don’t look like they are part of the No transaction fee program.

I think the transaction fees are usually applied on the purchase of the fund but not on the sale. If there is a fee it would likely be 49.95.

Yes I saw that earlier when searching their fees on the site. It appears to be for purchases however.

Attachments

Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,532

I moved from Edward Jones to Fidelity about 18 months ago. Most of my holdings at EJ were American Funds.Trying to figure out what it will cost to exchange mutual funds within the American Funds or go to cash or both.

Has anyone done this.

Thanks

There will be a fee to exchange one American Fund security for a different AF fund. Fee comes on the buy side of the transaction. With very few exceptions Fidelity funds are superior to American Funds. If you enter the ticker of the AF fund in the search box it will bring up the data for that fund but also list suggested similar Fidelity funds.

Going from an AF fund to a Fidelity fund should not incur fees. Once you are in Fidelity funds you can exchange within the fund family with no fees.

Be aware you will likely have capital gains when you sell your AF funds.

I moved from Edward Jones to Fidelity about 18 months ago. Most of my holdings at EJ were American Funds.

There will be a fee to exchange one American Fund security for a different AF fund. Fee comes on the buy side of the transaction. With very few exceptions Fidelity funds are superior to American Funds. If you enter the ticker of the AF fund in the search box it will bring up the data for that fund but also list suggested similar Fidelity funds.

Going from an AF fund to a Fidelity fund should not incur fees. Once you are in Fidelity funds you can exchange within the fund family with no fees.

Be aware you will likely have capital gains when you sell your AF funds.

This is the way it was explained to me regarding the tax ramifications.

"Transactions that are made within an individual retirement account (IRA) are not taxable. Stocks, funds and other securities can be purchased and sold within an IRA account without triggering any consequences. Potential tax consequences are only triggered when money is withdrawn from an IRA account altogether."

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

This is the way it was explained to me regarding the tax ramifications.

"Transactions that are made within an individual retirement account (IRA) are not taxable. Stocks, funds and other securities can be purchased and sold within an IRA account without triggering any consequences. Potential tax consequences are only triggered when money is withdrawn from an IRA account altogether."

That is correct, Qs likely missed your reply indicating it was IRA.

As far as the exchange, you should consider if it's something you really want to do. American Funds, though they carry somewhat higher expenses, have generally performed extremely well over the long term. I don't and have never owned any of their funds, but I have come across others who have been very happy with them.

Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,532

That is correct, Qs likely missed your reply indicating it was IRA.

I did miss that. It was in a subsequent post to the OP.

As far as the exchange, you should consider if it's something you really want to do. American Funds, though they carry somewhat higher expenses, have generally performed extremely well over the long term. I don't and have never owned any of their funds, but I have come across others who have been very happy with them.

I've found AF to be decent but Fidelity's are better.

Similar threads

- Replies

- 0

- Views

- 170