Yes public employee who push for every increasing pension benefits despite being told their plans were underfunded, they deserve some of the blame also.

This is totally wrong. It's not the responsibility of employees to provide the pension benefits they were promised. .... Was I suppose to exercise my clairvoyance when I was first offered the job and ask, hey guys, can you prove you will always fund this pension you've contracted for?

I

somewhat agree with GregLee on this. On the list of those who 'share the blame', I put the employees far down on the list. Ahead of them are the politicians who agreed to the benefits w/o proper funding, and at the top of the list, IMO, are the Union leaders, who negotiated for the benefits with full awareness that the funding was not adequate, and yet go back to their rank and file and tell them what a great job they did in getting these benefits. And kick the can down the road. And probably get out the vote for the politicians they 'negotiate' with.

It's as if I agreed to sell your car on commission, got you a 'great' price, took my 10% from you while all the while I knew full well the buyer was handing you a forged check.

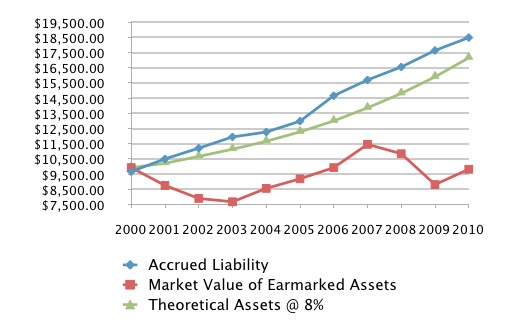

But employees (public and private) do need to wake up and look at the funding. DD is now an IL municipal employee, and I'm making her aware of just how poorly funded her pension is. I agree that most new employees probably would not be looking at this, but as time goes on it sure should be on their radar. They need to start making waves about it. They are the ones most directly affected - do something!

ERD,

In 2008 and 2009 there was, IMHO, feeling among many that irresponsible and greedy people ....

Thanks for the reply, but I don't see where you answered my question (

"Who is 'shifting the blame to the public service worker?") - you just deflected it.

After working over 20 years, putting in many extra hours, and CONTRIBUTING 6% OF MY OWN SALARY to my pension, I don't think the 30% pension I will be getting is excessive. Don't blame me for wanting to receive WHAT I HAVE EARNED. I CANNONT GO BACK IN TIME and do it over again.

First, this is mostly a red-herring ( a common one at that). I've seen very little talk and very close to zero actual action taken towards making any changes to what is already earned. In fact, it is prohibited by the State Constitution here in IL. Some are trying to interpret that as 'no future changes to the plan (like employee contribution %) at any time during their entire career'. So no, I am not blaming you for wanting to keep what you already earned. But ask the employees of UAL, if the fund goes dry - what is to be done? If that happened to me, I'd be plenty mad at those Union leaders I mentioned above that negotiated the contracts w/o also negotiating full funding. I'd protest if I could find a good street for it.

I have no idea if your pension is generous or not compared to the average private worker (not that it is that important, if it was part of the contract, you should get it). But if that 30% is COLAd, and if it is available at 55 YO, that changes the value of that number from what most private employees were getting. Mine is actually closer to 40% for 28 years, (and I doubt you would want to compare the hours put in over that time), so let's say 40% * 20/28 ~ 30%; but.... not COLA'd, so that effectively cuts the value in half, and if I took it at 55 YO, that cuts mine in half again, to 7.5%. Or, looking the the way - yours doubles 2 times to 120% compared to my 30%. Wanna trade? Devil's in the details.

-ERD50