No doubt -- I think it would be more like sales taxes where food is exempt, and probably medicine as well. Though I would expect some social engineering over which foods are exempt, with those perceived as "unhealthy" being hit with a VAT.

There was a bit of fuss a year or 2 back when Pringles had VAT added to them in the UK. The government decided that the amount of potato in a Pringle had fallen below the threshold to class it as a food item

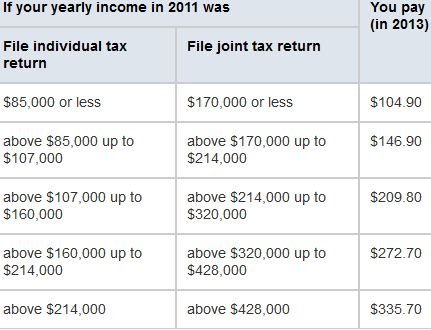

This table below is an example of what we would get to over here if VAT came to be, and food was excluded.

VFOOD8160 - Excepted items: snack products: examples of the VAT liability of common snack products

from the table, Pringles are subject to VAT, but Tortilla chips are not