Debinnov a

Recycles dryer sheets

- Joined

- Nov 2, 2013

- Messages

- 238

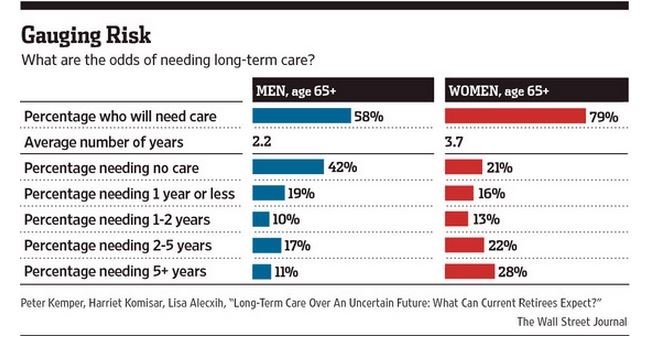

My DH and I are recently retired this year. Ages 58 and 52. We basically have no income until we take social security, which we will be taking as late as possible. This will use up quite a bit of our savings until we get to Social Security, but I'm still worried but long-term care.

DH has diabetes type 2 and I'm having a few non life threatening medical issues.

My questions are where is the best place to purchase this type of coverage? And does anyone have any information on the top firms to go with?

I'm on a mobile device and I tried to search the forums for LTC but just came up with millions of unrelated posts. Thanks!

DH has diabetes type 2 and I'm having a few non life threatening medical issues.

My questions are where is the best place to purchase this type of coverage? And does anyone have any information on the top firms to go with?

I'm on a mobile device and I tried to search the forums for LTC but just came up with millions of unrelated posts. Thanks!