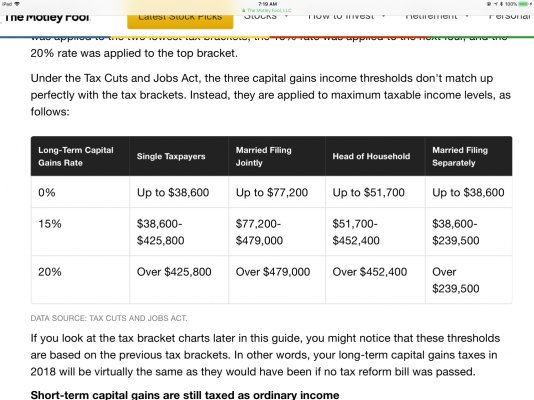

No, it is right... but you are right too... if the added income is preferenced income/LTCG then the marginal tax is 15%... but if the added income is ordinary income then the marginal tax rate is initially 27% and then 22%.

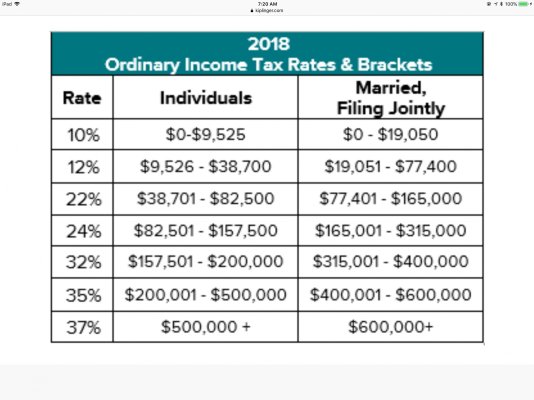

To make it simple lets assume that the top of the 12% tax bracket and the top of the 0% preferenced rate is $77,200 (MFJ) and ignore the $200 difference.

Taxpayer has $77,200 in TI, $30,000 in LTCG and $47,200 in ordinary income. They are in the 12% tax bracket for ordinary income and the 0% tax bracket for LTCG.

They then add $30,000 of ordinary income (by doing a tIRA withdrawal, or Roth conversion or whatever). That extra $30,000 of income makes their TI $107,200... $77,200 of ordinary income and $30,000 of LTCG. Their ordinary tax increases $3,600 ($30,000@12%) and their $30,000 of LTCG are now taxed at 15% rather than 0%, result in a $4,500 increase in tax. So their total tax increases by $8,100... 27% of the $30,000 increase in income.

If from the $107,200 they add more ordinary income it would be taxed at 22%... or more preferenced income/LTCG would taxed at 15%.

So their marginal rate is 27% for ordinary income added above the top of the 12% tax bracket for the amount of their preferenced income.... and then it drops to 22% for additional ordinary income or 15% for additional preferenced income.