You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FIRECalc Success Rate & RE

- Thread starter tb001

- Start date

Looking4Ward

Full time employment: Posting here.

Next month will be five years that I've been Fire'd. Wow, that sure went by fast.

I always shoot for a 100% success rate but my other parameters might be considered a bit unorthodox - I set the sample period to begin in 1938 and I use a 25 year time interval in order to include more cycles.

I then pay close attention to the projected account balances at the end of the term for all cycles. In every case, they are higher than what I started with. And that's with a current withdrawal rate of more than 4%.

If I throw in SS the picture looks even better. I'd say that five years ago I was a bit nervous with the projections but now that my portfolio is actually larger than what I started with I'm a little more comfortable with the numbers and will sometimes see what FireCalc says with a 95% success rate (both in terms of annual withdrawals and beginning portfolio) but I've never tested lower than that.

I always shoot for a 100% success rate but my other parameters might be considered a bit unorthodox - I set the sample period to begin in 1938 and I use a 25 year time interval in order to include more cycles.

I then pay close attention to the projected account balances at the end of the term for all cycles. In every case, they are higher than what I started with. And that's with a current withdrawal rate of more than 4%.

If I throw in SS the picture looks even better. I'd say that five years ago I was a bit nervous with the projections but now that my portfolio is actually larger than what I started with I'm a little more comfortable with the numbers and will sometimes see what FireCalc says with a 95% success rate (both in terms of annual withdrawals and beginning portfolio) but I've never tested lower than that.

Last edited:

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I also remember reading a thread awhile back whereby IIRC @Mathjak was making a case that if one has only a 95% Firecalc success vs. 100% success, it does matter in that if one is at a 95% success rate, then one's failures include the worst years to retire (1966, 1907, 1929, etc).

So even though one doesn't know the future for sure based on the past, wouldn't one at least want to "survive" the worst known historical years to begin retirement?

I thought it was an interesting argument.

So even though one doesn't know the future for sure based on the past, wouldn't one at least want to "survive" the worst known historical years to begin retirement?

I thought it was an interesting argument.

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,565

I'm shooting for a 100% success rate, but that's with a spending level that is 2x my annual expenses (e.g., 50% discretionary spending for travel). So, I'm projecting retirement at 50X my annual expenses saved. However, the actual plan is to spend at a 4.4% WR for the first 10 or so years so that I can travel, assuming no really bad SORR takes place. If they do, I'll deplete the cash bucket first, and if after 3 years, nothing's recovered, will cut spending, as I suspect many will.

Or use VPW.

Or use VPW.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

95% is fine IMO.

This one's based on Monte Carlo, so I think it gives similar results to other calculators, but doesn't factor in SS, Pension, or other income outside of your "savings balance today". I really like the MarketWatch calculator. You can add SS, pension, extra spending, etc., and it models draw-down based on your activity level, inflation, and future changes in spending. But it over-allocates housing costs, and this is largely not adjustable.

https://www.marketwatch.com/calculator/retirement/retirement-planning-calculator

Are these future saving in Future Dollars? I wish they’d all state more clearly or allow to toggle.

slowsaver

Recycles dryer sheets

I get 100% success rate from Firecalc. Still don't feel I can retire yet, mostly because my expense estimate assumes I will get 95% of my health insurance premium paid-for by an ACA subsidy. What with pending lawsuits, I don't believe it's a sure bet.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I get 100% success rate from Firecalc. Still don't feel I can retire yet, mostly because my expense estimate assumes I will get 95% of my health insurance premium paid-for by an ACA subsidy. What with pending lawsuits, I don't believe it's a sure bet.

That’s a risk I wouldn’t take. How do you fare, paying your own way?

slowsaver

Recycles dryer sheets

That’s a risk I wouldn’t take. How do you fare, paying your own way?

Well, I can certainly get a quote for insurance now -- but I feel it's kind of useless, given that I'm 45 and DH is 55. There is no way the rate will grow at any predictable rate (e.g. normal inflation rate), if past performance is any predictor.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Well, I can certainly get a quote for insurance now -- but I feel it's kind of useless, given that I'm 45 and DH is 55. There is no way the rate will grow at any predictable rate (e.g. normal inflation rate), if past performance is any predictor.

Oh, thought you were closer to FIRE.

slowsaver

Recycles dryer sheets

Oh, thought you were closer to FIRE.

Closer to FIRE, or closer to the age I can get medicare?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Closer to FIRE, or closer to the age I can get medicare?

Don’t understand.

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,565

Under the Retirement Spending Tab, there's a check box for "Show in Today's Dollars". Toggle away! I leave it checked.Are these future saving in Future Dollars? I wish they’d all state more clearly or allow to toggle.

95% is fine IMO.

"The other 50% is physical" ~ Yogi Berra

EastWest Gal

Thinks s/he gets paid by the post

I’m a real Nervous Nellie, all because of health insurance. I “retired” in 2014. I helped our medical group off and on, but in July 2016 I stopped working entirely. Our HI premiums doubled between 2016 and 2017, and then Congress tried to gut the ACA. I went back to work for HI. The entire time FireCalc says 100% success rate, even with high HI premiums.

But working is literally killing me. I gained back the weight I lost. It’s very stressful. I’ve stabilized and transferred several children to pediatric ICUs. I can feel the physical tightening in my neck and chest as I drive to work, especially for night shift.

Two dear friends have breast cancer. We have lost others in our lives who are younger than us. I need to quit and take care of me. Otherwise I won’t live until the projected 90+ age I use for FireCalc.

Keep in mind your life is more important than X travel budget when fussing between 95% and 100% success rate. You can still be happy spending a little less.

But working is literally killing me. I gained back the weight I lost. It’s very stressful. I’ve stabilized and transferred several children to pediatric ICUs. I can feel the physical tightening in my neck and chest as I drive to work, especially for night shift.

Two dear friends have breast cancer. We have lost others in our lives who are younger than us. I need to quit and take care of me. Otherwise I won’t live until the projected 90+ age I use for FireCalc.

Keep in mind your life is more important than X travel budget when fussing between 95% and 100% success rate. You can still be happy spending a little less.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Good point. FIRECALC or any other retirement calculator/method is just a tool to get you in the ballpark - it's an axe, not a scalpel. When I see folks splitting hairs over an exact WR, success rate or spending rate - I know they're going to be surprised in the long run, could be good, could be bad.Keep in mind your life is more important than X travel budget when fussing between 95% and 100% success rate. You can still be happy spending a little less.

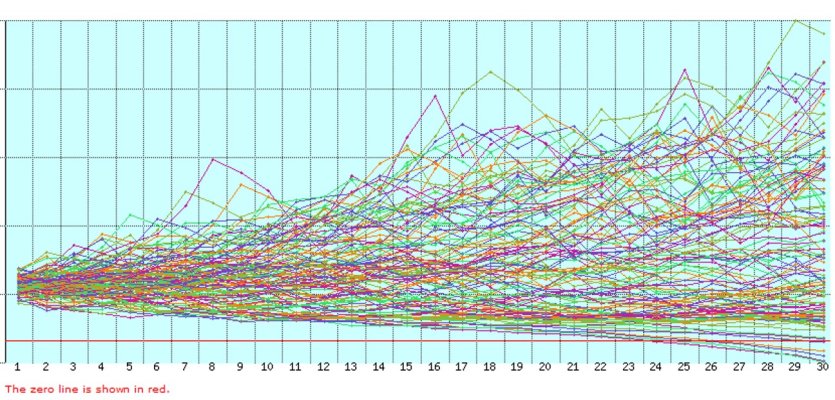

All you know when you retire and for the first 10+ years is your final outcome will probably fall somewhere in this range. What the final retirement financial outcome will look like will only become clear long after you retire...

Attachments

Tiger8693

Full time employment: Posting here.

The MarketWatch analysis gives me a much higher (positive) outcome than Fidelity Retirement Planner. Fido automatically goes to significantly below average, and changing to below average has a balance at her 95, but going to average has a higher balance than my start balance. I have to look into Fido planner much more detail.

jkern

Full time employment: Posting here.

How much flexibility do you have in your discretionary spending? (Travel, entertainment, recreation, etc.). Also, if you are a home owner, what is the condition of your house? Roof, HVAC, appliances, furniture, remodel, etc.? If your house is in tip top condition and won't need a lot of money over the next 25 years and your budget is fat with extras, you don't need 95% or 100% success rate in Firecalc.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The MarketWatch analysis gives me a much higher (positive) outcome than Fidelity Retirement Planner. Fido automatically goes to significantly below average, and changing to below average has a balance at her 95, but going to average has a higher balance than my start balance. I have to look into Fido planner much more detail.

Make sure you check if you clicked on future dollars or current dollars. That will big difference.

How much flexibility do you have in your discretionary spending? (Travel, entertainment, recreation, etc.). Also, if you are a home owner, what is the condition of your house? Roof, HVAC, appliances, furniture, remodel, etc.? If your house is in tip top condition and won't need a lot of money over the next 25 years and your budget is fat with extras, you don't need 95% or 100% success rate in Firecalc.

Good questions. In a really bad scenario, about 30% of our budget could be cut/deferred, but we really don’t want to have to cut that hard. Realistically, more like 15%.

About 6-8% of our budget is for home repair/maintenance/improvements. We just relocated and the house is ~20yrs old, so have a reasonable to do list of wants and things we know we’ll probably need to replace in the next few years. That said, probably 3 yrs of budgeted spend would cover all of the ‘need to do’ stuff for a long time (new Hvacs, appliances, etc).

I haven’t included any income from alternative investments in our estimates. One of those is a bar that’s been paying about 3-6% of our budget for probably 10yrs or so. Obviously could go away, but don’t think it goes to zero right away.

In a bad market scenario over the next 10-15 years, I think DH and I would both try to find at least part time employment to fund some of the ‘extras’. Easier to think about doing when you have kids in school and couldn’t travel anyway! Realistically, we could cut a LOT by downsizing and cutting extras/travel, but would really like to be able to give our kids experiences we didn’t have. I just wish our spend wasn’t so front end loaded.

I'm 49, single, FIREd 3 years, and have three kids 24, 19, 17. I'm quite logic-oriented and comfortable with risk. AA of 93/7. I would feel comfortable with a spend rate that would have been 95% historically safe for 40 years. I spend far less than that and need to work on spending more.

Note that FIREcalc already includes SORR, because it iterates the planning period over each start date. So when it comes up with 4% (or whatever), that's 4% assuming you started at the worst SORR we've seen so far.

At the end of the day, you rolls your dice and you takes your chances. I think looking at in terms of regret is helpful: Which would you regret more - working another X years to get to 100% and then realize you didn't need it, or retire early and risk having to cut back or go back to work?

FIREcalc is a historical-based calculator. VG is a Monte Carlo simulator. They are similar in that they both provide data about retirement readiness, but how they do so is quite different. IME, Monte Carlo simulators tend to be a percent or two more conservative than historical calculators.

Is this actually correct? If you enter spending and firecalc gives you a 95% success rate, doesn’t it inherently mean that 5/100 cycles failed. And if you’re retiring at the peak of a bull market, doesn’t that increase your likelihood of being in one of those 5 failed cycles, so depending on market conditions when you retire, that 95% risk could actually be higher? (Ignoring the fact that stagflation seems to be the main portfolio killer at the 95% levels...)

Is this actually correct? If you enter spending and firecalc gives you a 95% success rate, doesn’t it inherently mean that 5/100 cycles failed. And if you’re retiring at the peak of a bull market, doesn’t that increase your likelihood of being in one of those 5 failed cycles, so depending on market conditions when you retire, that 95% risk could actually be higher? (Ignoring the fact that stagflation seems to be the main portfolio killer at the 95% levels...)

Of course. But FIRECalc, along with every other calculator of any kind, can't predict the future. It simply tells you what would have happened in the past. Its advantage is that it uses a lot of "past" to give you a good idea of what might happen in the future.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The MarketWatch analysis gives me a much higher (positive) outcome than Fidelity Retirement Planner. Fido automatically goes to significantly below average, and changing to below average has a balance at her 95, but going to average has a higher balance than my start balance. I have to look into Fido planner much more detail.

@Cocheesehead and I among others are fairly familiar with the Fidelity calculator, so fire away if you need some more insight.

Most folks who use Fido tend to use the "significantly below average" module. It is considered a 90% success rate, which for a Monte Carlo simulation more so matches up with a 95% success rate with Firecalc.

I’m a real Nervous Nellie, all because of health insurance. I “retired” in 2014. I helped our medical group off and on, but in July 2016 I stopped working entirely. Our HI premiums doubled between 2016 and 2017, and then Congress tried to gut the ACA. I went back to work for HI. The entire time FireCalc says 100% success rate, even with high HI premiums.

But working is literally killing me. I gained back the weight I lost. It’s very stressful. I’ve stabilized and transferred several children to pediatric ICUs. I can feel the physical tightening in my neck and chest as I drive to work, especially for night shift.

Two dear friends have breast cancer. We have lost others in our lives who are younger than us. I need to quit and take care of me. Otherwise I won’t live until the projected 90+ age I use for FireCalc.

Keep in mind your life is more important than X travel budget when fussing between 95% and 100% success rate. You can still be happy spending a little less.

This is for sure what we’re balancing. ~18mo ago, my job was for sure damaging my health, family and relationship. An intense job with lots of travel and a three hr commute. Just wasn’t working with two young kids. We made big changes, relocated, and I went to 75% working from home. I still travel about once a month.

Is there any opportunity for you to go part time or transition to a less stressful job for a few years, just to have insurance? Could you relocate to a state with better aca benefits?

USGrant1962

Thinks s/he gets paid by the post

Is this actually correct? If you enter spending and firecalc gives you a 95% success rate, doesn’t it inherently mean that 5/100 cycles failed. And if you’re retiring at the peak of a bull market, doesn’t that increase your likelihood of being in one of those 5 failed cycles, so depending on market conditions when you retire, that 95% risk could actually be higher? (Ignoring the fact that stagflation seems to be the main portfolio killer at the 95% levels...)

You are correct. The % number in FIRECalc (and Bengen/Trinity) is kind of wonky because it is percent of historical cases that worked. As you point out, your personal success percentage depends on starting conditions and unpredictable future market events.

Being financially conservative, I've always targeted 100% in FIRECalc, not as a numeric forecast but rather to be able to say "If I could have survived the Great Depresson and stagflation, I'm certainly good to go - IMO."

OTOH, "failure" in FIRECalc assumes you make no spending adjustments in bad conditions and includes an inflation adjustment that is arguably unrealistic compared to actual retiree spending patterns (see Bernicke or the spending smile). So as long as you are flexible, something like 95% is quite safe, again IMO.

Similar threads

- Replies

- 15

- Views

- 1K

- Replies

- 0

- Views

- 230

- Replies

- 39

- Views

- 3K