marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,456

What a glum thread!

But lets also remember that during the Great Depression there were people (my grandfather among them) who made a fortune. Not everyone was destitute. IIRC unemployment was 25% meaning 75% still had jobs.

I'm not saying it wasn't horrific but there were opportunities out there. Please! I'm not trying to be provocative or minimize people's pain at the time...let's not go down that path!!

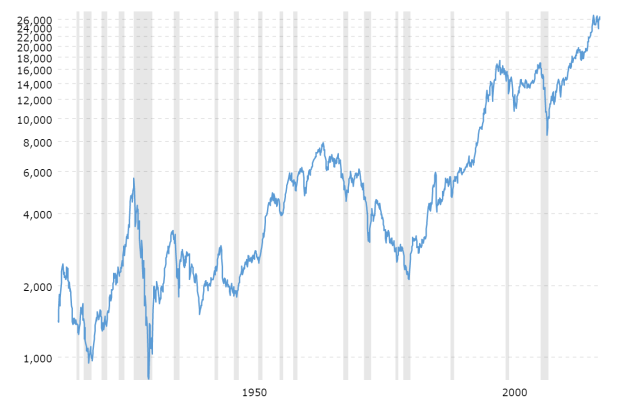

Again, I suspect that were it not for the modern controls in place, 2008 could've been worse than 1929 but for a number of reasons it was kept in check. While we must learn from it, I just don't see us able to compare today's modern markets with 1929.

How many of us here on this forum took advantage of stock or real estate opportunities during the '08-'09 ("end of the world as we know it") period? I sure did.

As an aside, my great-grandmother dropped dead on October 29, 1929 when her husband came home and told her the banks were closed. Right there in the hallway...so it wasn't all sunshine for her son, my grandfather.

But lets also remember that during the Great Depression there were people (my grandfather among them) who made a fortune. Not everyone was destitute. IIRC unemployment was 25% meaning 75% still had jobs.

I'm not saying it wasn't horrific but there were opportunities out there. Please! I'm not trying to be provocative or minimize people's pain at the time...let's not go down that path!!

Again, I suspect that were it not for the modern controls in place, 2008 could've been worse than 1929 but for a number of reasons it was kept in check. While we must learn from it, I just don't see us able to compare today's modern markets with 1929.

How many of us here on this forum took advantage of stock or real estate opportunities during the '08-'09 ("end of the world as we know it") period? I sure did.

As an aside, my great-grandmother dropped dead on October 29, 1929 when her husband came home and told her the banks were closed. Right there in the hallway...so it wasn't all sunshine for her son, my grandfather.

Last edited: