audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

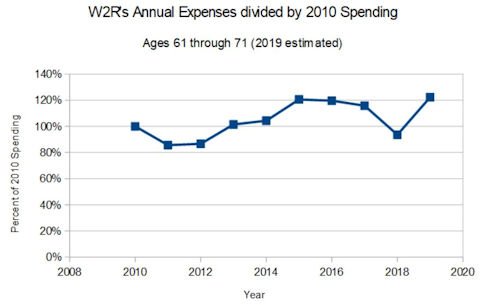

We are definitely trying to do more now while we can and very cognizant of the go go years.

It just happens that we still don’t exceed a somewhat conservative withdrawal rate at current higher portfolio levels.

We’re also considering giving heirs a major advance.

It just happens that we still don’t exceed a somewhat conservative withdrawal rate at current higher portfolio levels.

We’re also considering giving heirs a major advance.