Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

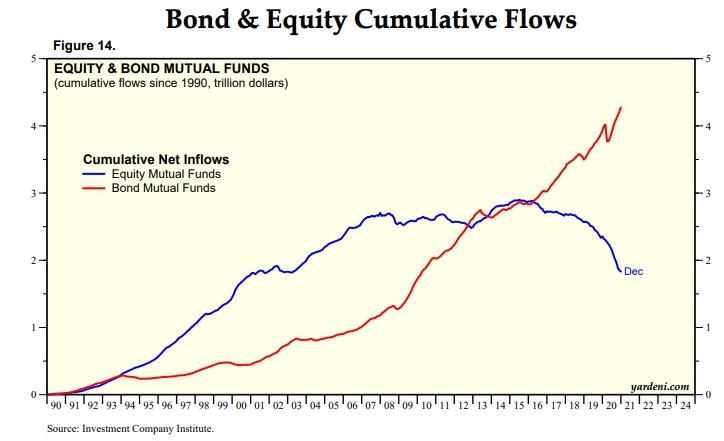

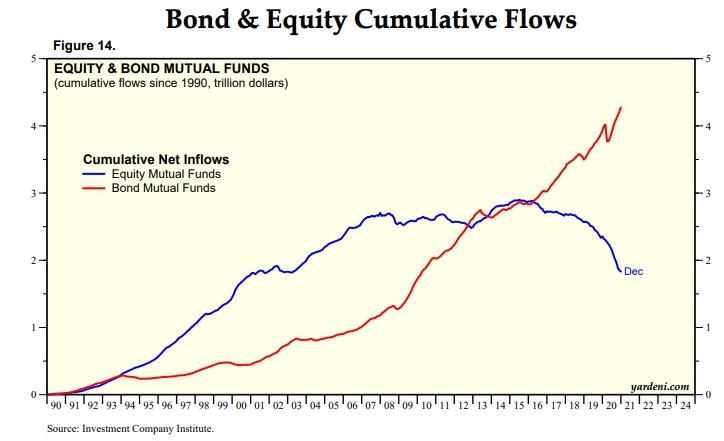

The chart below would seem to indicate that investors are strongly increasing their bond allocations at the expense of equities. Somehow I do not get that impression with folks on the ER site mostly holding steady (Bogleheads?). FWIW, I have increased my equities strongly over the last year but AA was pretty steady before that.

From this Carlson article: https://awealthofcommonsense.com/2021/06/why-arent-interest-rates-higher/

From this Carlson article: https://awealthofcommonsense.com/2021/06/why-arent-interest-rates-higher/

Baby boomers hold something like $70 trillion in wealth. They own most of the financial assets. Ten thousand people from this cohort are retiring every day through the end of this decade.