ThinkAhead

Confused about dryer sheets

- Joined

- Aug 4, 2015

- Messages

- 2

Hi! This is my first time posting. I am 60 years old and retirement for me will likely be in the next year or two, simply because I'm not ready. I've worked my whole life and I can't imagine NOT making money and NOT saving it. And, I like my job. It's creative, really flexible and close to home. And, I'm finally making what I'm worth. With that said, day by day, I'm feeling more ready and with a new President in my company, retirement may come sooner than I think.

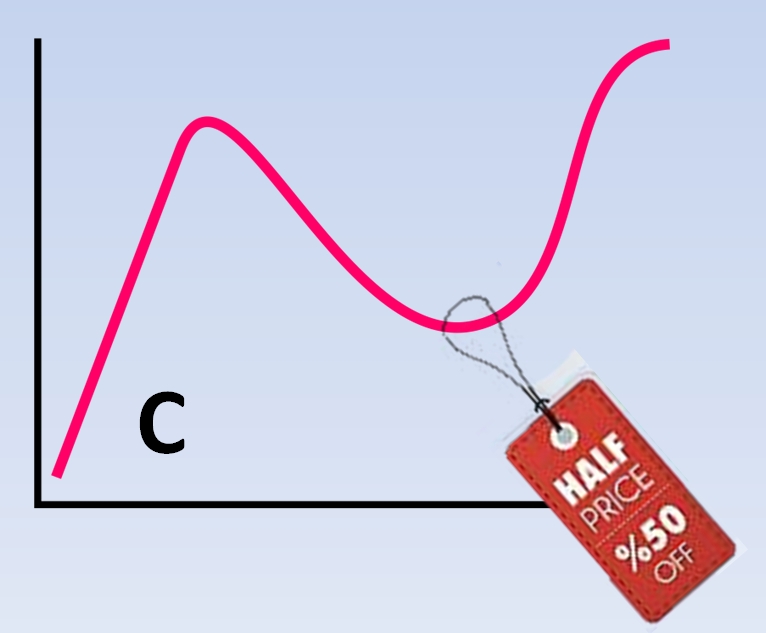

I am married to a guy who makes good money, but works really hard for it. We got married late in life (age 40). We keep our money separate, but also have a joint savings and checking account. We have no debt. I am worth 1.3 million and he is worth double that amount. Here's the thing - my money has been in CD's and savings accounts for the past 10 years (at his suggestion because he saw how upset I got when I lost money during the last stock market downturn) and obviously, I've made NO RETURN on my savings all these years. He was investing his savings and was doing well, but then lost $300,000 in day trade about five years ago. It hurt. Because of that and his feeling that I should NOT invest my money in the stock market, I missed all of the gains over the last 10 years.

It has bothered me - A LOT - that my money just sat there making nothing all of these years. But, I was too frightened to make a move and because everything we both knew about the market said it should NOT be going up like it was.

So, here I sit. And the question is, is it too late and/or too risky to invest at this point in time? Should I just be happy with what I have saved? Would love your thoughts!

I am married to a guy who makes good money, but works really hard for it. We got married late in life (age 40). We keep our money separate, but also have a joint savings and checking account. We have no debt. I am worth 1.3 million and he is worth double that amount. Here's the thing - my money has been in CD's and savings accounts for the past 10 years (at his suggestion because he saw how upset I got when I lost money during the last stock market downturn) and obviously, I've made NO RETURN on my savings all these years. He was investing his savings and was doing well, but then lost $300,000 in day trade about five years ago. It hurt. Because of that and his feeling that I should NOT invest my money in the stock market, I missed all of the gains over the last 10 years.

It has bothered me - A LOT - that my money just sat there making nothing all of these years. But, I was too frightened to make a move and because everything we both knew about the market said it should NOT be going up like it was.

So, here I sit. And the question is, is it too late and/or too risky to invest at this point in time? Should I just be happy with what I have saved? Would love your thoughts!

Last edited: