Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I know...have to not get caught up in "I should have done...."

Bottom line after 6.5 years my portfolio is up ~45% including withdrawals since January 2017

I was just thinking about the withdrawal aspect. Do most folks calculate like FREE866 - IOW including their withdrawals? Or do you exclude withdrawals?

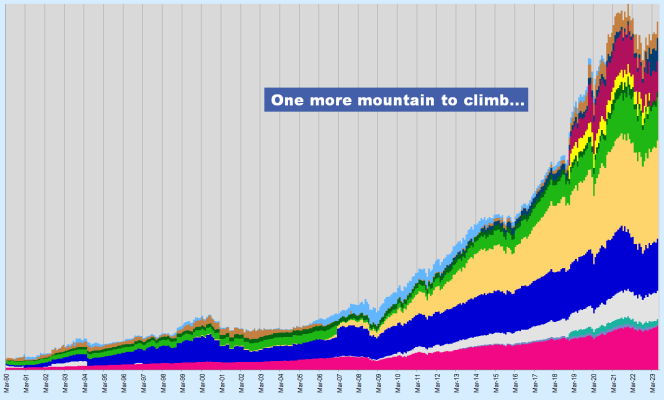

I don't pay a lot of attention to my growth, but just check NW once a year. I don't exclude withdrawals which have gotten significantly higher of late, and yet my stash continues to climb fairly consistently. Even as stocks (in general) have slid over the past couple of years, my NW continues to grow - for the most part because my old Megacorp stock that I didn't get rid of following FIRE has been on a tear. If all my investments did that well, I'd be a millionaire. Wait! I AM a millionaire. Never mind.