You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation is giving lower income retirees smaller COLA increases

- Thread starter Sandy & Shirley

- Start date

- Status

- Not open for further replies.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I live in Canada and when I start my SS, they will tax 85% of it regardless of my income. Just sayin'.

How much do you pay for part B, part D etc. of your healthcare in Canada?

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,514

Reading this thread is giving me a headache.

I'm just glad I get SS after many years of working, saving and retiring with no pension and no family inheritance. I'll pay my share of taxes on the SS income along with everyone else. There's more important things in life than to worry about than stuff like SS income tax.

+1 Especially when there's nothing anyone can do about it.

Just tell me how much to write the check for and then leave me alone. (harumpff!)

W2R

Moderator Emeritus

Reading this thread is giving me a headache.

I'm just glad I get SS after many years of working, saving and retiring with no pension and no family inheritance. I'll pay my share of taxes on the SS income along with everyone else. There's more important things in life than to worry about than stuff like SS income tax.

+1 (except I did get a moderate inheritance that I haven't touched, and a tiny mini-pension).

To add to your very good points, I have all that I need or want (the key being to not need or want very much). My only child "married well" and is doing fine without any help from me.

At this point, it's all just a game and I'm not playing. Too busy enjoying the best time in my life. I'm having a ball just enjoying all this free time.

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,227

How much do you pay for part B, part D etc. of your healthcare in Canada?

Drugs are not free in Canada. Seniors aged 65 years and over automatically qualify for the ODB Program. Seniors pay a $100 annual deductible before they are eligible for drug coverage. After the deductible is paid, seniors then pay a co-payment of up to $6.11 toward the dispensing fee per prescription.

Most medical costs (seeing doctors, diagnostic tests, surgery) are covered by the healthcare system, but when I went to ER last time (non-life-threatening injury), I waited in the waiting room for 8 hours (11am to 7pm) to finally see a doctor. It has a very long wait for diagnostic tests like MRI as well.

Taxes are higher for me here and they put in extra rules (They fully tax US dividends and I cannot do Roth IRA conversions, for example (Once you add any money into Roth IRA after your move to Canada, the account becomes fully taxable.))

If you're low-income with a meager SS and can get free medical (Medicaid?) in the US, you may be better off in the US, but that's just my guess.

Last edited:

aaronc879

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jan 10, 2006

- Messages

- 5,357

The OP is upset with the Social Security taxation algorithm, in which a lesser percentage of SS goes into your AGI for lower income people.

The solution, obviously, is to make 85% of SS benefits taxable for EVERYBODY.

Lower income folks already have a low tax bracket; no need to make it more complicated.

Plus, this is a step in the right direction toward alleviating the shortfall that SS is facing a decade from now...

That would cause more problems than it solves. You are talking about reducing the net incomes of those that can least afford it. I personally don't want seniors living on the streets, i'm weird that way.

djsander

Recycles dryer sheets

Being retired I’ll just figure out what taxes to pay and pay them. I won’t spend countless hours to squeeze the last penny out of Uncle Sam. Life’s too short.

Al18

Full time employment: Posting here.

Shirley,

It seems you could save some money on Federal taxes if you could withdraw money from after tax accounts, such as a bank/credit union CD and a brokerage, where you would be paying less tax on capitol gains and qualified dividends. Here’s a link to a tax calculator https://www.irscalculators.com/tax-calculator

It seems you could save some money on Federal taxes if you could withdraw money from after tax accounts, such as a bank/credit union CD and a brokerage, where you would be paying less tax on capitol gains and qualified dividends. Here’s a link to a tax calculator https://www.irscalculators.com/tax-calculator

I think the difference OP highlighted here is because the threshold for SS taxation is not indexed for inflation. Had those been, I think it would have worked out the same. However, the lack of indexing is a sneaky tax increase over time and with the program in financial trouble, you're not likely to see it indexed.

Less well off people may face high effective marginal rates throughout their lives due to income and asset based assistance they may get at different times - welfare, housing assistance, Medicaid, child care, ACA subsidies, college financial assistance, medicare subsidies (stepped down via IRMAA tiers), tax brackets, SS taxation. As these are phased out for higher income folks, the loss of the break can create very high effective tax brackets. But that is inherent in the math of offering breaks to less well off folks in the first place. The transition from preferences/benefits to no preferences has to occur somewhere and those transitions mathematically must have higher marginal rates.

Less well off people may face high effective marginal rates throughout their lives due to income and asset based assistance they may get at different times - welfare, housing assistance, Medicaid, child care, ACA subsidies, college financial assistance, medicare subsidies (stepped down via IRMAA tiers), tax brackets, SS taxation. As these are phased out for higher income folks, the loss of the break can create very high effective tax brackets. But that is inherent in the math of offering breaks to less well off folks in the first place. The transition from preferences/benefits to no preferences has to occur somewhere and those transitions mathematically must have higher marginal rates.

Al18

Full time employment: Posting here.

With better planning, you could be paying less taxes and have more money to spend. If you worked until 59 1/2 and retired, but decided to wait 5 years until you collect SS. You do a Roth IRA conversion of $10K per year. Since you aren't realizing much income during these first 5 years, the extra Federal Taxes are only 5% or $500 per year. After 5 years, you've converted $50K and paid an extra $2500 in federal taxes. You've wisely invested 50% in a SP500 fund paying 7% per year and CD's paying 4% per year. Your Roth IRA balance is $63750 at the end of 5 years and you withdraw 6% or $3825 per year for at least the next 20 years, never paying additional federal tax on this account again.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I live in Canada and when I start my SS, they will tax 85% of it regardless of my income. Just sayin'.

The US should probably do that.

The 0% and 50% of SS being taxed stratas are really a gift/tax relief granted to lower and middle income taxpayers. In reality a higher percentage of their benefit is growth and lower percent are a return of contributions because of the way the bend points work.

Sandy & Shirley's complaint is that some of that tax benefit gets unwound as your income goes up. Duh, or course it does.

So is it that the income is being taxed more as Sandy & Shirley suggests or more that some of the tax benefit that they receive as a low/middle income taxpayer is unwound. I think the latter, but in any case there is no sense bitching about it because it is what is it and is unlikely to change.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think the difference OP highlighted here is because the threshold for SS taxation is not indexed for inflation. Had those been, I think it would have worked out the same. However, the lack of indexing is a sneaky tax increase over time and with the program in financial trouble, you're not likely to see it indexed. ...

And I think that not indexing the threshold for SS taxation was intentional. The Committee wanted to just go with a flat 85% but that wasn't going to fly politically, so at first they settled for 0% and 50%. Then later they came up with the 0%, 50%, 85% scheme. By not indexing the thresholds for inflation they knew that in the long run it would sweep more and more taxpayers into the 85% territory, which is just what they wanted to do and thought was the right answer to begin with.

And I agree.

Last edited:

Out-to-Lunch

Thinks s/he gets paid by the post

I The transition from preferences/benefits to no preferences has to occur somewhere and those transitions mathematically must have higher marginal rates.

This is brilliantly, concisely stated.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+2

Sandy & Shirley

Recycles dryer sheets

Let’s put some real numbers to what I keep saying on line!

I worked and paid FICA tax for 49 years and I have the records from Social Security showing the dollar amount of FICA tax I paid each year. I just went to macrotrends to get the average closing price and the yearly closing price for the Dow Jones, DJI, for each year from 1965 through 2013. Using the average closing price each year and the FICA tax paid each year, if I had merely purchase DJI shares with each paycheck’s FICA withholding tax, I would have purchased 38.027 shares of DJI. With the 2013 DJI closing price of 16,576.66, the total value of my DJI investment would have been $630,358, and you can double that if you include the matching contributions from my employer. To go a step further, the DJI close for Dec 1, 2023 was 36,245.50, so my DJI would be worth about 1.3 million, again double that with the matching contributions from my employer.

The bottom line is that our elected representatives did not properly manage the Social Security TRUST Fund, they did whatever they could to get reelected. In 1935 the Treasury Department declared that our Benefits would be tax free. In 1983 and 1993 our elected representative passed laws to tax our benefits and funnel those taxes back into the TRUST fund.

So yes, I am constantly using my Math and Computer skills to find every way I can to stop the government from taking my well earn benefits back from me, and I also do what I can to tell average, lower, and median income retirees how they can also keep their well earned benefits.

I worked and paid FICA tax for 49 years and I have the records from Social Security showing the dollar amount of FICA tax I paid each year. I just went to macrotrends to get the average closing price and the yearly closing price for the Dow Jones, DJI, for each year from 1965 through 2013. Using the average closing price each year and the FICA tax paid each year, if I had merely purchase DJI shares with each paycheck’s FICA withholding tax, I would have purchased 38.027 shares of DJI. With the 2013 DJI closing price of 16,576.66, the total value of my DJI investment would have been $630,358, and you can double that if you include the matching contributions from my employer. To go a step further, the DJI close for Dec 1, 2023 was 36,245.50, so my DJI would be worth about 1.3 million, again double that with the matching contributions from my employer.

The bottom line is that our elected representatives did not properly manage the Social Security TRUST Fund, they did whatever they could to get reelected. In 1935 the Treasury Department declared that our Benefits would be tax free. In 1983 and 1993 our elected representative passed laws to tax our benefits and funnel those taxes back into the TRUST fund.

So yes, I am constantly using my Math and Computer skills to find every way I can to stop the government from taking my well earn benefits back from me, and I also do what I can to tell average, lower, and median income retirees how they can also keep their well earned benefits.

TheWizard

Thinks s/he gets paid by the post

...So yes, I am constantly using my Math and Computer skills to find every way I can to stop the government from taking my well earn benefits back from me, and I also do what I can to tell average, lower, and median income retirees how they can also keep their well earned benefits.

Well, good luck with that...

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,514

So yes, I am constantly using my Math and Computer skills to find every way I can to stop the government from taking my well earn benefits back from me, and I also do what I can to tell average, lower, and median income retirees how they can also keep their well earned benefits.

Good luck, Don Quixote!

- Joined

- Apr 14, 2006

- Messages

- 23,229

In 1960, the United States Supreme Court ruled that you don't have a vested property interest in Social Security. See Flemming v. Nestor, 363 U.S. 603 (1960). It is just another tax while you are working and is not earmarked or set aside for you personally in any way, as a private pension or annuity would be. So you can do all the calculations you want, but they, and your reliance on the words "Trust Fund," are ultimately unavailing.

Last edited:

- Joined

- Nov 17, 2015

- Messages

- 14,064

my well earn benefits back from me

But isn't that bit the missing point? SS isn't just "Aeri saved this in SS and gets hers from that pot" but that we all pay into one big pot, and then get earnings back per some table. It isn't meant to even out at the individual level. It also pays to those who didn't work nearly as much (W2 work), to spouses, to those who were very low income. It's a social safety net for folks who can no longer expect to earn a living wage, all of us.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

...The bottom line is that our elected representatives did not properly manage the Social Security TRUST Fund, they did whatever they could to get reelected. In 1935 the Treasury Department declared that our Benefits would be tax free. In 1983 and 1993 our elected representative passed laws to tax our benefits and funnel those taxes back into the TRUST fund.

So yes, I am constantly using my Math and Computer skills to find every way I can to stop the government from taking my well earn benefits back from me, and I also do what I can to tell average, lower, and median income retirees how they can also keep their well earned benefits.

Where you say in 1935 the Treasury Department declared that our Benefits would be tax free you are referring to the revenue rulings by Treasury in the early days of SS. And it is true that the Treasury Department issued revenue rulings that stated that SS benefits were tax free. However, revenue rulings are simply an interpretation of how the law applies to a particular set of facts and circumstances. If the law changes, then the interpretation of the law changes. And that is what happened. A Committee studying SS concluded that SS being tax free was a mistake by Treasury and Congress changed the law in response, just like all laws are subject to change, refinement, closing of loopholes, etc.

You seem to be hung up on thinking that the Treasury Department was king and had the final say, but that is not the case.

Since your math and computer skills are so refined, perhaps you should expand your horizons to social studies and capitalization.

No pension fund would invest pension contributions 100% in stocks as you suggest earlier in your post. While an individual can chose to do that with their own money when you are a fiduciary and managing other people's money like in a pension fund the rules are different and safer investments are required.

Last edited:

Al18

Full time employment: Posting here.

Aerides, well said.

I’ve read about taxes on retirement benefits around the developed world, and most nations will tax 85% benefits and the other 15% is not taxed because it’s considered return of principle.

I’ve read about taxes on retirement benefits around the developed world, and most nations will tax 85% benefits and the other 15% is not taxed because it’s considered return of principle.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

But isn't that bit the missing point? SS isn't just "Aeri saved this in SS and gets hers from that pot" but that we all pay into one big pot, and then get earnings back per some table. It isn't meant to even out at the individual level. It also pays to those who didn't work nearly as much (W2 work), to spouses, to those who were very low income. It's a social safety net for folks who can no longer expect to earn a living wage, all of us.

Exactly, SS is akin to a defined benefit pension plan whereas Shirley erroneously thinks it is akin to a defined contribution pension plan, hence their confusion.

Out-to-Lunch

Thinks s/he gets paid by the post

Do you know what the "I" in FICA stands for? What would your hypothetical DJI account balance be if you were paralyzed in a car accident in 1983?

Closet_Gamer

Thinks s/he gets paid by the post

Let’s put some real numbers to what I keep saying on line!

I worked and paid FICA tax for 49 years and I have the records from Social Security showing the dollar amount of FICA tax I paid each year. I just went to macrotrends to get the average closing price and the yearly closing price for the Dow Jones, DJI, for each year from 1965 through 2013.

Apples-and-Oranges.

Social Security is a quasi-guaranteed, inflation adjusted pension. I say quasi-guaranteed because Congress can and will change the rules from time-to-time. But beneficiaries are not subject to volatility nor have any risk of principle loss. There is also nothing to leave for your heirs.

A stock market investment is none of those things. Over the long haul of history, yes, stock investing generates a higher return and may leave an estate behind. But that's like comparing a SPIA to investing in the stock market. Different structure, different purposes, different risks, different guarantees.

When I was younger I was all-in on the idea that the government should just give me a 401k style fund with a mandatory contribution level. That may still be a better system IF it could be managed to keep the crooks in the financial services industry away from it.

But as I've gotten older, I understand the upside of a guaranteed income stream in ones later years and the need to protect folks who perhaps don't have the skills or earning power that I did.

When I do retirement planning, I typically assume I won't get SS. That is not a viable thought for the majority of the population.

I don’t fully follow all of your numbers, but it would technically be true that if your income is indexed for inflation, if your marginal income tax rate, including impacts of social security taxes, increased from year one to year two, thst for that particular year your net income will grow less than inflation compared to the prior year. But that only happens once, and if your marginal rate decreases it goes the other way. Due to the nonlinear nature of social security taxation figuring out the true marginal rate can be difficult.I did the math / spreadsheet because this is what I expected, and here are the numbers!

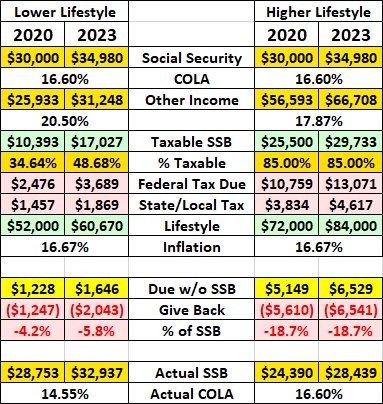

I [FONT="]started with two individuals with a $30,000 annual SSB in 2020. One living a $1,000 a week lifestyle and the other with a $6,000 a month lifestyle. Using my Maryland tax brackets, I calculated the Other Income they would need to pay their Federal, State, and Local taxes to end up with their desired lifestyles, $52,000 and $72,000 after tax![/FONT]

[FONT="]

[/FONT]

Then I performed the compounded COLA adjustments (16.6%) to raise their SSB from $30,000 to $34,980 for 2023, and to keep the number fairly round, I adjusted their desired lifestyle by 16.67%.

Note how the Lower Lifestyle individual’s Other Income had to increase by a higher percentage because the Higher Lifestyle Individual was already paying the maximum 85% SSB taxability while the Lower Lifestyle individual’s taxable SSB increased by 14.24%.

Then I followed the 1983 and 1993 legislative process and recalculated each Federal Tax Due without the taxable SSB, subtracted one tax due from the other to determine how much the IRS would be transferring back to the Social Security and Health Insurance trust funds.

The final step was to calculate all of the actual SSB everyone was getting, what they were getting from the Trust Fund minus what they were Giving Back to the Trust Fund.

Once you reach your maximum 85% taxability, you get your full COLA adjustments. While you are working your way through all of the taxable SSB steps, your COLA will be less!

This is all in the name that was determined in the 1935 legislation. Our Social Security payroll tax is deposited in the Social Security Trust fund - - - - We are TRUSTing the government with our retirement money!

- Status

- Not open for further replies.

Similar threads

- Replies

- 15

- Views

- 1K

- Replies

- 329

- Views

- 27K

- Replies

- 18

- Views

- 8K