Sandy & Shirley

Recycles dryer sheets

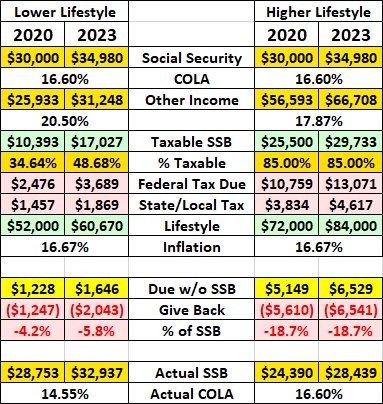

I did the math / spreadsheet because this is what I expected, and here are the numbers!

I [FONT="]started with two individuals with a $30,000 annual SSB in 2020. One living a $1,000 a week lifestyle and the other with a $6,000 a month lifestyle. Using my Maryland tax brackets, I calculated the Other Income they would need to pay their Federal, State, and Local taxes to end up with their desired lifestyles, $52,000 and $72,000 after tax![/FONT]

[FONT="]

[/FONT]

Then I performed the compounded COLA adjustments (16.6%) to raise their SSB from $30,000 to $34,980 for 2023, and to keep the number fairly round, I adjusted their desired lifestyle by 16.67%.

Note how the Lower Lifestyle individual’s Other Income had to increase by a higher percentage because the Higher Lifestyle Individual was already paying the maximum 85% SSB taxability while the Lower Lifestyle individual’s taxable SSB increased by 14.24%.

Then I followed the 1983 and 1993 legislative process and recalculated each Federal Tax Due without the taxable SSB, subtracted one tax due from the other to determine how much the IRS would be transferring back to the Social Security and Health Insurance trust funds.

The final step was to calculate all of the actual SSB everyone was getting, what they were getting from the Trust Fund minus what they were Giving Back to the Trust Fund.

Once you reach your maximum 85% taxability, you get your full COLA adjustments. While you are working your way through all of the taxable SSB steps, your COLA will be less!

This is all in the name that was determined in the 1935 legislation. Our Social Security payroll tax is deposited in the Social Security Trust fund - - - - We are TRUSTing the government with our retirement money!

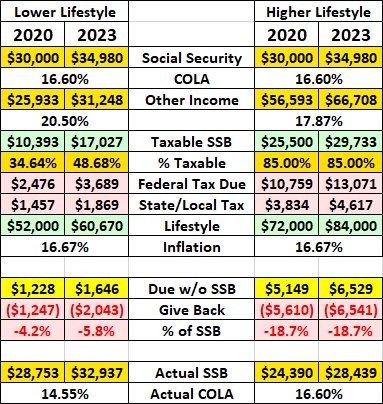

I [FONT="]started with two individuals with a $30,000 annual SSB in 2020. One living a $1,000 a week lifestyle and the other with a $6,000 a month lifestyle. Using my Maryland tax brackets, I calculated the Other Income they would need to pay their Federal, State, and Local taxes to end up with their desired lifestyles, $52,000 and $72,000 after tax![/FONT]

[FONT="]

[/FONT]

Then I performed the compounded COLA adjustments (16.6%) to raise their SSB from $30,000 to $34,980 for 2023, and to keep the number fairly round, I adjusted their desired lifestyle by 16.67%.

Note how the Lower Lifestyle individual’s Other Income had to increase by a higher percentage because the Higher Lifestyle Individual was already paying the maximum 85% SSB taxability while the Lower Lifestyle individual’s taxable SSB increased by 14.24%.

Then I followed the 1983 and 1993 legislative process and recalculated each Federal Tax Due without the taxable SSB, subtracted one tax due from the other to determine how much the IRS would be transferring back to the Social Security and Health Insurance trust funds.

The final step was to calculate all of the actual SSB everyone was getting, what they were getting from the Trust Fund minus what they were Giving Back to the Trust Fund.

Once you reach your maximum 85% taxability, you get your full COLA adjustments. While you are working your way through all of the taxable SSB steps, your COLA will be less!

This is all in the name that was determined in the 1935 legislation. Our Social Security payroll tax is deposited in the Social Security Trust fund - - - - We are TRUSTing the government with our retirement money!