It's all good. But as point of reference, if you had $30K cash and "spent" it by buying a stock or gold, would you consider that a spend of this year? What about if you had $300K and "spent" it on a home?

As you started this thread though it's all for fun, so indeed let's just party on.

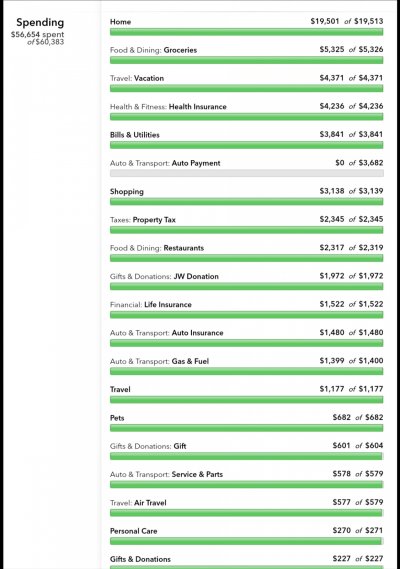

I put anything that I paid cash for as an expense, unless it's savings. Putting money in savings (or stocks, etc) obviously isn't an expense. Having said that, it does make for some really odd looking years. For example, my normal spending is around $100K - $130K. My spending for 2012 was over $500K since I bought a house and 2 cars using cash.