How can I model this? Right now, all my expenses are in my model and I have 100% Ps. The model says I can spend $25k / year on BTD from 55-70 (I have other inputs for after 70, so let's focus on 55-70). Great. But, If remove the BTD from the model, I can pull out a chunk of money and still maintain 100% Ps on the base model. To illustrate:

$2M portfolio = 100% Ps with $25k / year BTD

$1.5M portfolio = 100% Ps with no BTD

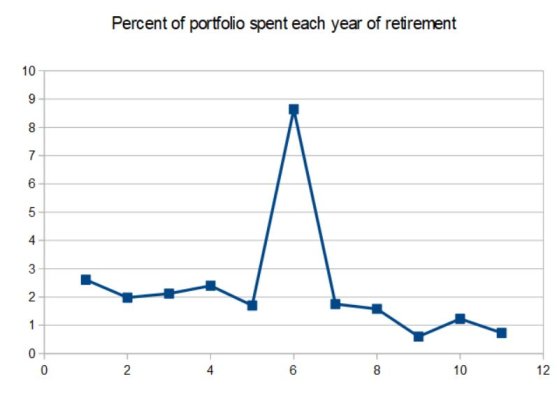

Ok, so now I have $500k to play with and I want to spend it all between 55-70. I will use a variable percent withdrawal (VPW) for this. The VPW worksheet show that I can start with $40k. Then you withdraw the percentage the worksheet says each year. If the portfolio tanks, you withdraw the prescribed % but the dollar amount is less and vice versa. Basically, I want to spend as much as possible as early as possible without risking my base portfolio.

I think I can just model this in my spreadsheet and not have to create a separate account at Fidelity. Makes life simpler.

Does all this make sense? Is it a good idea?