Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,554

Looking at five and ten years, over 90% of actively managed funds beat their benchmarks. Again, whether the market is going up, down, or sideways.

And the OP's time frame is 6 years until retirement. Sounds like one would be a fool to settle for market returns when you have a 90% chance of outperforming the market.

Not only that but if there is a big correction, and money is deployed, it's virtually certain that you will seriously beat market returns for a couple of years with an aggressive growth fund. That margin of outperforming the market after a deep dive will be substantial. Since the OP's question was conditioned on what to do in a correction I think my advice was sound.

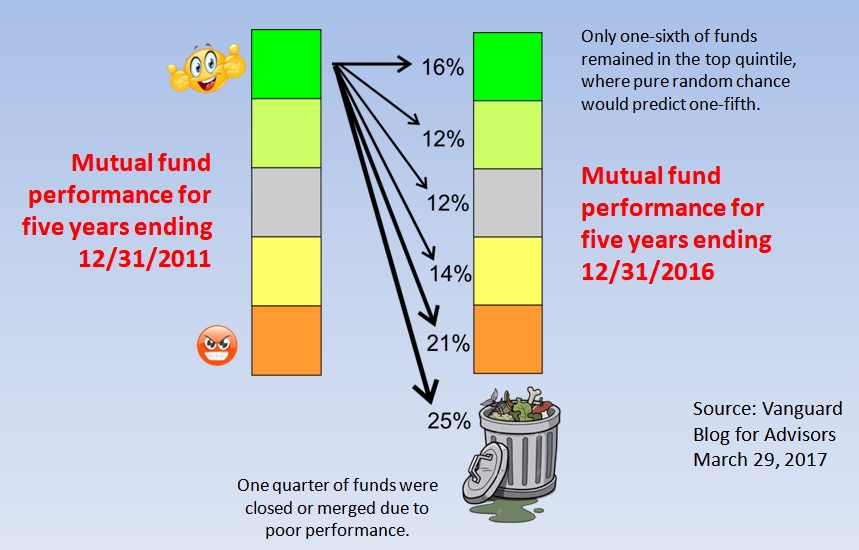

And the rest of the story is that past performance is not predictive, so there is no way to identify the tiny number of long term winners ahead of time. @Qs Laptop has no facts to contradict this because there are none.

Well, with an index fund you know you will get market returns. You know there is NO CHANCE that you will outperform the market.

Also, fund managers and stock pickers do build a track record. Some are definitely skilled.

The other amusing aspect is the naive idea that, if there was someone who could consistently and predictably win in the market, that he/she would be slaving away as a mutual fund manager, selling that expertise for a pittance. No chance.

Maybe they like having the resources and contacts available to them in their job. Who knows what they are doing on the side with their own money with this information.

Last edited: