Each year at this time Megacorp mails me the Annual Funding Notice for its pension plan. It's jolly reading, believe me.

Especially charming is the bit where it shows the Funding Target Attainment Percentage, which has been sinking for the past three years despite a torrid stock market. Of course, that may not be huge a surprise when you consider that the majority of the money is invested in debt instruments instead of in equities.

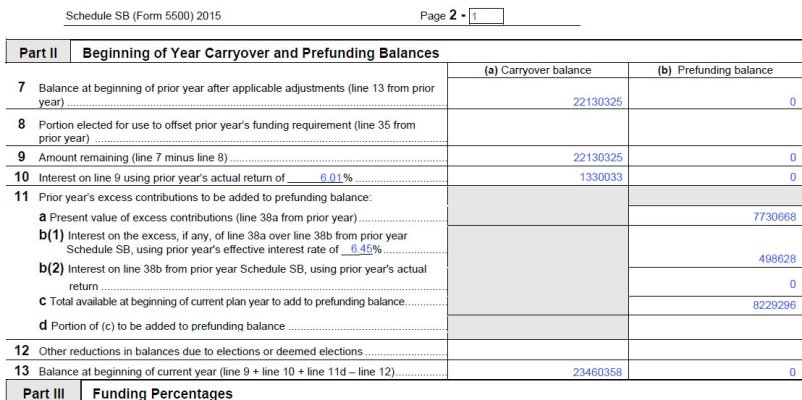

But with every edition, I get a bit irritated because the AFN includes some accounting-speak that ordinary mortals like me don't fully comprehend. Perhaps one of the actuaries on forum can explain exactly what "Funding Standard Carryover Balance" and "Prefunding Balance" mean. I've tried scanning the interwebs, but the explanations I find there are still couched in jargon.

Is there anybody here who can explain these terms in words that I can understand? Even better, can anybody explain the implications of these values being nonzero? (I suspect when they are nonzero, it's not very good, since their arithmetic effect is to reduce the Net Plan Assets.)

Thank you in advance,

M

Especially charming is the bit where it shows the Funding Target Attainment Percentage, which has been sinking for the past three years despite a torrid stock market. Of course, that may not be huge a surprise when you consider that the majority of the money is invested in debt instruments instead of in equities.

But with every edition, I get a bit irritated because the AFN includes some accounting-speak that ordinary mortals like me don't fully comprehend. Perhaps one of the actuaries on forum can explain exactly what "Funding Standard Carryover Balance" and "Prefunding Balance" mean. I've tried scanning the interwebs, but the explanations I find there are still couched in jargon.

Is there anybody here who can explain these terms in words that I can understand? Even better, can anybody explain the implications of these values being nonzero? (I suspect when they are nonzero, it's not very good, since their arithmetic effect is to reduce the Net Plan Assets.)

Thank you in advance,

M