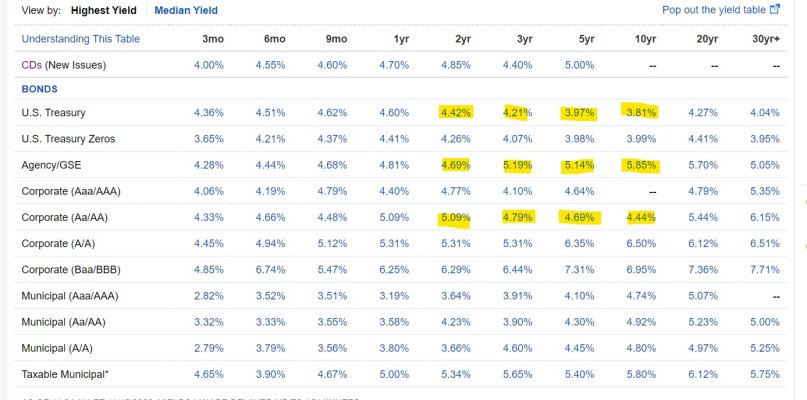

Is anybody here familiar with the spread between agencies and treasuries or agencies and corporates? I'm wondering if it is more a function of credit risk or the fact that agencies are callable. The Fidelity table compares YTW so the only issue about them being callable is what you'd be able to reinvest the money in down the road.

I find it interesting that the Agency vs. Treasury spread is only 17bp for 2 year duration but almost 200bp for 10 year. Also that Agencies yield less than AA Corporates at 2 years but a lot more for 10 year.

I'm guessing that the reason is the potential for them to be called but if they are called, the 5.85% YTW is pretty attractive for a potentially short dated bond. Am I missing something?

Thanks.

I find it interesting that the Agency vs. Treasury spread is only 17bp for 2 year duration but almost 200bp for 10 year. Also that Agencies yield less than AA Corporates at 2 years but a lot more for 10 year.

I'm guessing that the reason is the potential for them to be called but if they are called, the 5.85% YTW is pretty attractive for a potentially short dated bond. Am I missing something?

Thanks.